Western Union Exchange Rate in the Philippines Today

Sending money across borders has become an integral part of our globalized world. For Filipinos working abroad or those receiving remittances from loved ones overseas, the exchange rate plays a crucial role. Understanding the nuances of the Western Union exchange rate in the Philippines today can significantly impact the value of the money being sent and received.

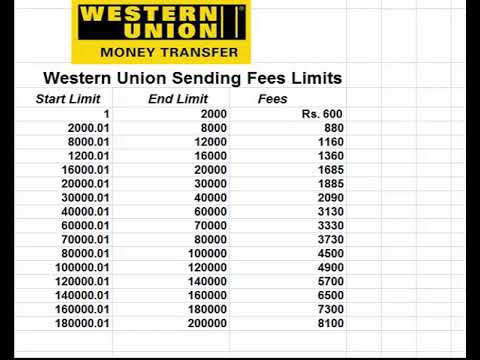

Navigating the world of international money transfers can be daunting, especially with fluctuating exchange rates. When choosing a service like Western Union, it's essential to be aware of the current Philippine Peso exchange rate offered. This involves not just the base exchange rate but also any fees or charges that might apply, impacting the final amount received.

Western Union offers a convenient way to send and receive money in the Philippines. However, understanding the dynamic nature of currency exchange is crucial for making informed decisions. Factors influencing the Western Union exchange rate today in the Philippines include global market fluctuations, currency demand and supply, and economic conditions both locally and internationally.

Transparency is key when it comes to money transfers. While Western Union provides a valuable service, it's important to compare their rates and fees with other available options. This empowers senders and receivers to choose the most cost-effective and efficient method for their needs. Knowledge is power in this realm.

Beyond simply checking the current exchange rate, consider other aspects like transfer speed, accessibility of Western Union locations, and customer service. A holistic understanding of the process can significantly enhance the overall experience and ensure a smoother transaction.

Western Union's history dates back to 1851 in the United States, initially focusing on telegraph services. They later expanded into money transfers, becoming a global leader in the field. The importance of Western Union's exchange rate in the Philippines today lies in the significant amount of remittances flowing into the country, contributing substantially to the Philippine economy.

A major issue related to the Western Union exchange rate is its potential fluctuation. The rates can change frequently, affecting the final amount received. To stay updated, individuals can check the Western Union website or app for the latest exchange rate information.

One benefit of using Western Union is its wide network of agent locations, making it accessible in various parts of the Philippines. Another advantage is the speed of transactions, often allowing for near-instantaneous money transfers. Lastly, the familiarity and established reputation of Western Union can provide peace of mind for users.

To send money via Western Union, one can visit a local agent location, use the Western Union website, or utilize their mobile app. Information typically required includes the recipient's name, location, and the amount being sent.

Advantages and Disadvantages of Using Western Union

| Advantages | Disadvantages |

|---|---|

| Wide network of agent locations | Potentially higher fees compared to some online services |

| Fast transfer speeds | Exchange rate fluctuations can impact the amount received |

| Established reputation and brand recognition | Requires specific information about the recipient |

Frequently Asked Questions:

1. How can I check the current Western Union exchange rate for the Philippines? - Check the Western Union website or app.

2. What fees are associated with Western Union transfers? - Fees vary based on the amount sent and the destination.

3. How long does a Western Union transfer take? - Transfers can be near-instantaneous or take a few business days.

4. How can I receive money from Western Union in the Philippines? - Visit a Western Union agent location with valid identification.

5. What are the payment options for sending money through Western Union? - Options include cash, debit cards, and credit cards.

6. Can I track my Western Union transfer? - Yes, tracking is available through the Western Union website or app.

7. What are the identification requirements for receiving money? - Valid government-issued photo ID is usually required.

8. Is there a limit on the amount I can send or receive? - Limits vary and may depend on local regulations and the user's transfer history.

Tips for using Western Union: Compare rates with other providers, consider transfer fees, track your transfer, and keep your transaction details secure.

In conclusion, the Western Union exchange rate in the Philippines today is a vital aspect of international money transfers. Understanding the factors influencing these rates, comparing available options, and staying informed about fees and procedures can empower both senders and recipients to make the most of their transactions. By being proactive and knowledgeable, individuals can navigate the complexities of currency exchange and ensure that their hard-earned money reaches its destination with maximum value and efficiency. Taking the time to research and compare rates from various providers can lead to significant savings in the long run. This understanding not only benefits individual users but also contributes to the broader economic landscape of the Philippines. By staying informed, we can all participate more effectively in the global flow of remittances.

Chevy express 2500 van mastering your lug nut size

Protecting your investment the ultimate guide to marine canvas waterproofing

The enduring allure of floral heart tattoos