Unlocking Your Healthcare Potential with Humana Gold Plus Plan

Are you seeking a health insurance plan that offers comprehensive coverage and valuable benefits? Navigating the complexities of Medicare can be daunting, but understanding the advantages of plans like the Humana Gold Plus Plan can significantly empower your healthcare decisions. This comprehensive guide will delve into the Humana Gold Plus Plan, exploring its features, benefits, and how it can potentially enhance your overall well-being.

Choosing the right Medicare Advantage plan requires careful consideration of your individual needs and preferences. The Humana Gold Plus Plan is designed to provide enhanced coverage beyond Original Medicare, often including prescription drug coverage, dental, vision, and hearing benefits. Understanding the nuances of this plan can help you determine if it aligns with your healthcare goals.

Humana has a long history of providing health insurance solutions, and the Gold Plus Plan reflects their commitment to offering comprehensive coverage. This plan aims to address the evolving healthcare needs of Medicare beneficiaries, offering a broader range of benefits to potentially improve access to quality care.

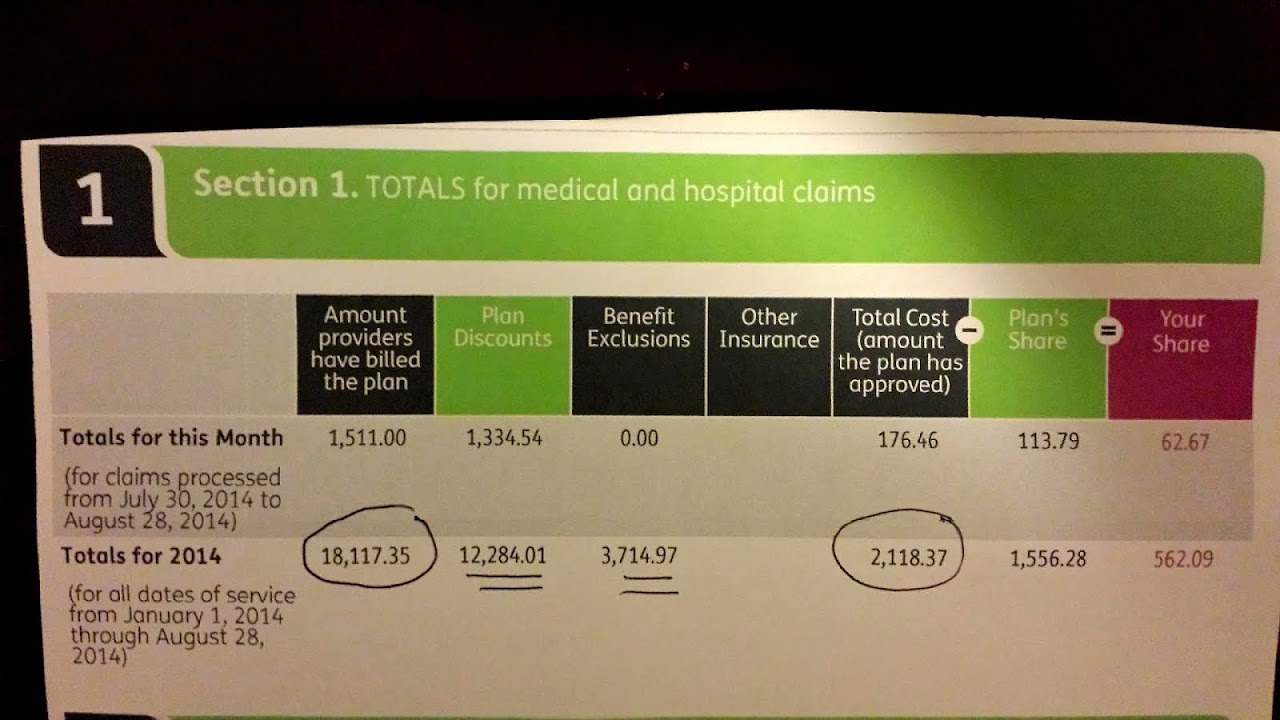

The Humana Gold Plus Plan holds significant importance for individuals seeking more comprehensive coverage than Original Medicare. It seeks to reduce out-of-pocket expenses and expand access to essential healthcare services. Potential issues to consider include network restrictions, premium costs, and benefit limitations, which will be explored further in this article.

The specifics of Humana Gold Plus Plan benefits can vary based on your location and the specific plan you choose. It's crucial to consult the official plan documents and speak with a Humana representative to get the most accurate and up-to-date information regarding coverage, costs, and benefits. This personalized approach can help you avoid surprises and make informed decisions about your healthcare.

Understanding the Humana Gold Plus Plan requires clarity on key terms. "Medicare Advantage" refers to plans offered by private insurance companies approved by Medicare, providing benefits beyond Original Medicare. "Premium" is the monthly cost you pay for the plan. "Copay" is a fixed amount you pay for covered services, like a doctor visit.

Benefit 1: Expanded Coverage. The Humana Gold Plus Plan often includes coverage for prescription drugs, dental, vision, and hearing, which Original Medicare doesn't typically cover. Example: You might receive coverage for routine eye exams and glasses.

Benefit 2: Lower Out-of-Pocket Costs. Many plans have a maximum out-of-pocket limit, protecting you from excessive expenses. Example: After reaching your limit, the plan may cover a larger portion of your healthcare costs.

Benefit 3: Additional Wellness Programs. Some plans include wellness programs like gym memberships or fitness classes. Example: You might receive a free gym membership to encourage healthy habits.

Action Plan: 1. Visit the Humana website or call their customer service line. 2. Review the available Humana Gold Plus Plans in your area. 3. Compare plan benefits, costs, and provider networks. 4. Consult with a licensed insurance agent if you have questions. 5. Enroll in the plan that best meets your needs.

Advantages and Disadvantages of Humana Gold Plus Plans

| Advantages | Disadvantages |

|---|---|

| Expanded coverage beyond Original Medicare | Potential network restrictions |

| Potential for lower out-of-pocket costs | Monthly premiums |

| Access to wellness programs | Varying plan benefits depending on location |

FAQ:

1. What is the Humana Gold Plus Plan? Answer: A Medicare Advantage plan offering additional benefits.

2. What does it cover? Answer: Benefits can vary, but often include prescription drugs, dental, vision, and hearing.

3. How much does it cost? Answer: Costs vary based on location and specific plan choice.

4. Who is eligible? Answer: Generally, individuals eligible for Medicare.

5. How do I enroll? Answer: Through the Humana website, phone, or a licensed agent.

6. Can I see any doctor? Answer: Typically, you'll need to see doctors within the plan's network.

7. What if I move? Answer: Plan availability may change if you relocate.

8. Can I change plans? Answer: You can typically change plans during the Annual Enrollment Period.

Tips & Tricks: Review your plan annually to ensure it still meets your needs. Take advantage of wellness programs offered. Keep your doctor informed about your plan coverage.

In conclusion, the Humana Gold Plus Plan offers a valuable opportunity to enhance your healthcare experience with potentially broader coverage and additional benefits. Understanding its features, advantages, and disadvantages empowers you to make informed decisions about your healthcare future. By carefully considering your individual needs and researching the available options, you can choose a plan that aligns with your goals and provides peace of mind. Take the time to thoroughly evaluate your options, consult with resources like the Humana website and licensed insurance agents, and prioritize your long-term well-being by selecting a plan that supports your unique healthcare journey. Don't delay – explore the possibilities of the Humana Gold Plus Plan today and unlock the potential for a healthier tomorrow.

The square delight a journey into the ritter sport world

Hilarious marital quips navigating matrimony with humor

Discovering dunnellon delight exploring 2438 sw persimmon ln

.jpg)