Unlocking the Hajj: Your Guide to Tabung Haji Registration

Dreaming of embarking on the Hajj pilgrimage? It's a journey of a lifetime, a profound spiritual experience that millions aspire to undertake. But navigating the registration process can feel daunting. This guide will demystify the process of Hajj registration through Tabung Haji, Malaysia's pilgrims fund board, providing you with the essential information you need to embark on this sacred journey.

For many Muslims in Malaysia, the Hajj is a pivotal life goal. Tabung Haji, established to facilitate savings for this very purpose, acts as a gateway for aspiring pilgrims. Understanding how to register with Tabung Haji and subsequently apply for the Hajj is crucial. This guide aims to break down the intricacies of the Tabung Haji Hajj registration process, from initial account opening to application submission.

Tabung Haji was founded in 1963 to help Muslims save for their Hajj pilgrimage. The organization manages funds, provides Hajj services, and operates as an Islamic financial institution. Its existence is integral to the Hajj journey for Malaysian Muslims, providing financial support and administrative guidance. Over the decades, Tabung Haji has evolved, streamlining its registration process and incorporating digital platforms to make the process more accessible.

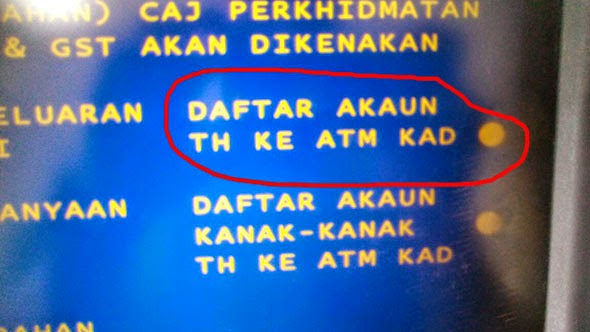

Registering with Tabung Haji is the first step towards applying for the Hajj. This involves opening an account and contributing savings regularly. The accumulated savings are then used towards the Hajj expenses when the time comes for your pilgrimage. Beyond its religious significance, Tabung Haji registration also holds economic implications, promoting financial planning and contributing to the national economy.

One of the primary challenges associated with Hajj registration is the long waiting list. Due to limited quotas allocated by Saudi Arabia, there can be significant delays between registration and the actual pilgrimage. Understanding the waiting period and managing expectations is key to navigating this process smoothly. This guide will equip you with the knowledge to navigate this aspect and plan accordingly.

The Hajj registration process through Tabung Haji generally involves opening an account, making regular savings, and then applying for the Hajj when eligible. The application process requires specific documents and fulfills certain criteria. Detailed explanations of these requirements will be provided later in this guide.

Opening a Tabung Haji account offers several benefits beyond facilitating Hajj registration. These include profit sharing based on Islamic principles, tax relief on contributions, and access to other Islamic financial products and services.

One successful example is the story of a young family who diligently saved through Tabung Haji over many years, finally fulfilling their dream of performing the Hajj together. Their consistent savings and meticulous planning allowed them to overcome financial hurdles and embark on their spiritual journey.

Advantages and Disadvantages of Tabung Haji Hajj Registration

| Advantages | Disadvantages |

|---|---|

| Systematic Savings Plan | Long Waiting List |

| Government Managed and Regulated | Limited Quota |

Best Practices for Tabung Haji Hajj Registration:

1. Register Early: Start saving early to maximize your returns and secure your place on the waiting list.

2. Consistent Savings: Make regular contributions to your Tabung Haji account to reach your savings goal.

3. Understand the Requirements: Familiarize yourself with the necessary documents and eligibility criteria.

4. Stay Updated: Keep abreast of any changes in the registration process or Hajj quotas.

5. Seek Guidance: Consult with Tabung Haji officials or experienced individuals for clarification and support.Frequently Asked Questions (FAQs):

1. What is the minimum age for Tabung Haji registration? - Any age.

2. What documents are required for account opening? - Identification card and supporting documents.

3. How long is the Hajj waiting list? - It varies, check the official Tabung Haji website for the latest information.

4. Can I withdraw my savings before going for Hajj? - Yes, but subject to certain conditions.

5. How much does the Hajj cost? - Varies depending on the package chosen.

6. Can I transfer my Tabung Haji account to someone else? - No, accounts are non-transferable.

7. What happens if I pass away before performing the Hajj? - The savings can be inherited by the next of kin.

8. How do I check my Hajj application status? - Through the Tabung Haji website or mobile app.

Tips and Tricks: Utilize online resources and the Tabung Haji mobile app for convenient account management and updates.

Embarking on the Hajj is a monumental spiritual endeavor. Registering with Tabung Haji is the first crucial step towards realizing this dream. By understanding the process, benefits, and potential challenges, you can navigate the journey with greater clarity and confidence. Start your savings today, stay informed, and prepare for a life-altering experience. The Hajj is a journey of faith, and Tabung Haji serves as a vital bridge for Malaysian Muslims to fulfill this sacred obligation. Early registration, consistent savings, and a thorough understanding of the process will pave the way for a smoother and more fulfilling Hajj experience. Don't delay; begin your journey today.

University of waterloo swimming pool your guide to aquatic fitness

Exploring khao phanom bencha national park a thai treasure

Fifa 24 on xbox one the final whistle