Unlocking Financial Clarity: Mastering Accounting Worksheets

Ever feel like you're swimming in a sea of numbers when it comes to your finances? Wouldn't it be amazing if there was a simple, organized way to make sense of it all? That's where accounting worksheets, or "formato de hoja de trabajo contabilidad" in Spanish, come in. They're like a secret weapon for anyone who wants to take control of their financial life, whether it's for a small business, a personal budget, or even a complex corporate setting.

An accounting worksheet is essentially a structured document, often a spreadsheet, used to organize financial data before it’s formally entered into accounting journals and ledgers. Think of it as a preliminary step, a chance to gather, analyze, and adjust your financial information before it becomes part of the permanent record. This process allows for a more thorough review and helps prevent errors in the final financial statements.

The history of accounting worksheets is intertwined with the evolution of accounting itself. Double-entry bookkeeping, the foundation of modern accounting, dates back to 15th-century Italy. As businesses grew more complex, the need for a system to organize and verify transactions before finalizing them became evident. This led to the development of worksheets, tools that allowed accountants to perform calculations, check for errors, and ensure accuracy before transferring information to the official books.

The importance of accounting worksheets cannot be overstated. They offer a crucial checkpoint in the accounting cycle, ensuring data integrity and reducing the risk of errors. They provide a clear, concise overview of a company's financial position, which is invaluable for decision-making. For small businesses, a simple accounting worksheet can be the difference between a clear understanding of profitability and a confusing jumble of numbers.

One common issue related to accounting worksheets is the potential for complexity. While simple worksheets can be easily managed, larger organizations with complex transactions might find themselves dealing with intricate, multi-tab spreadsheets. This can lead to confusion and errors if not handled carefully. Utilizing software designed specifically for accounting can help mitigate this risk.

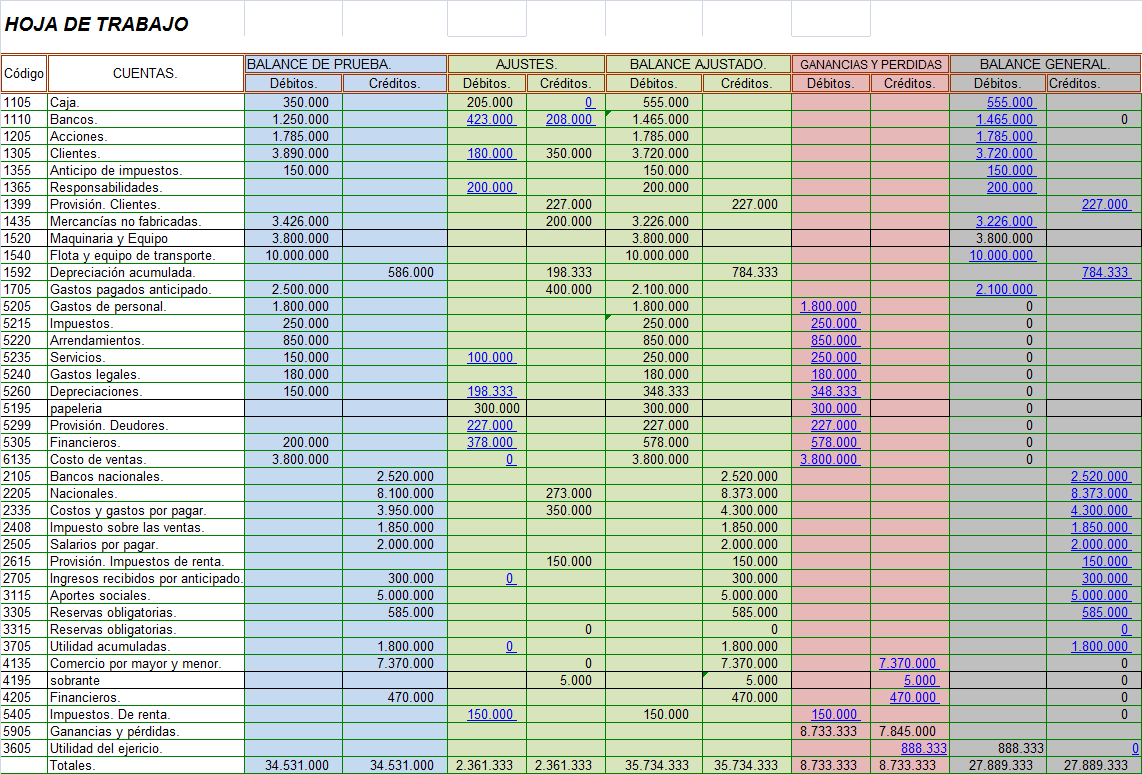

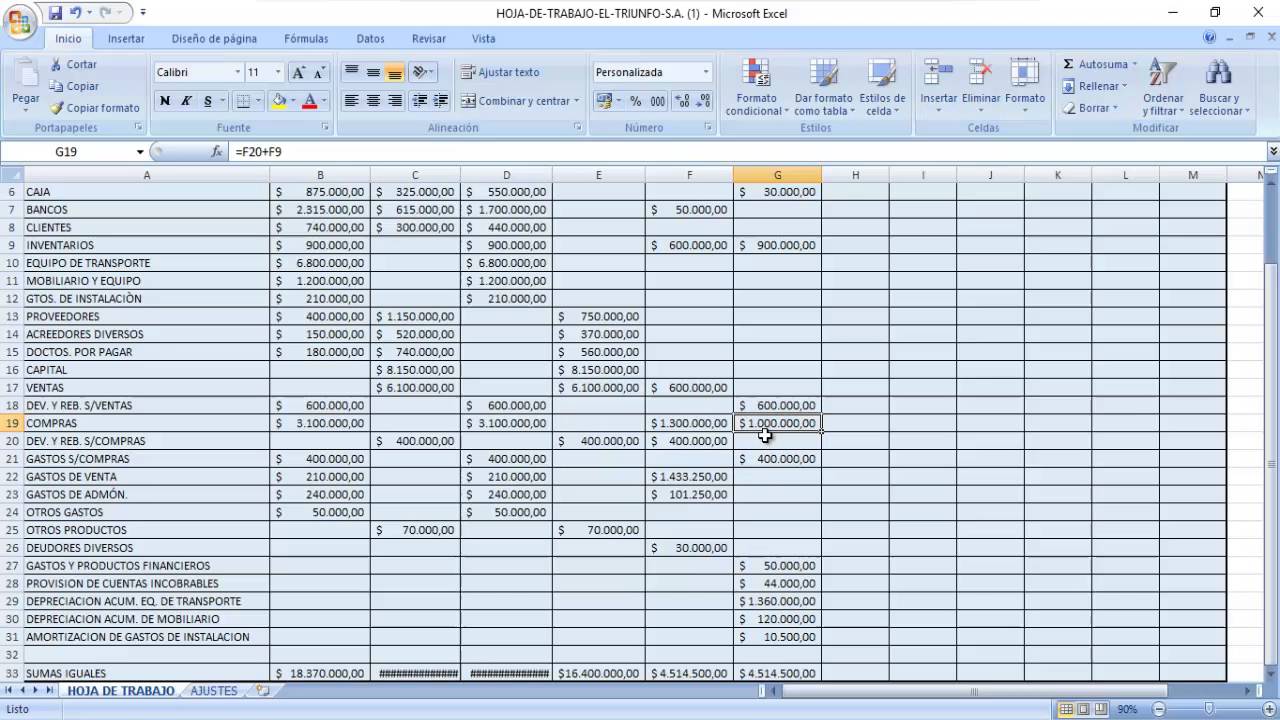

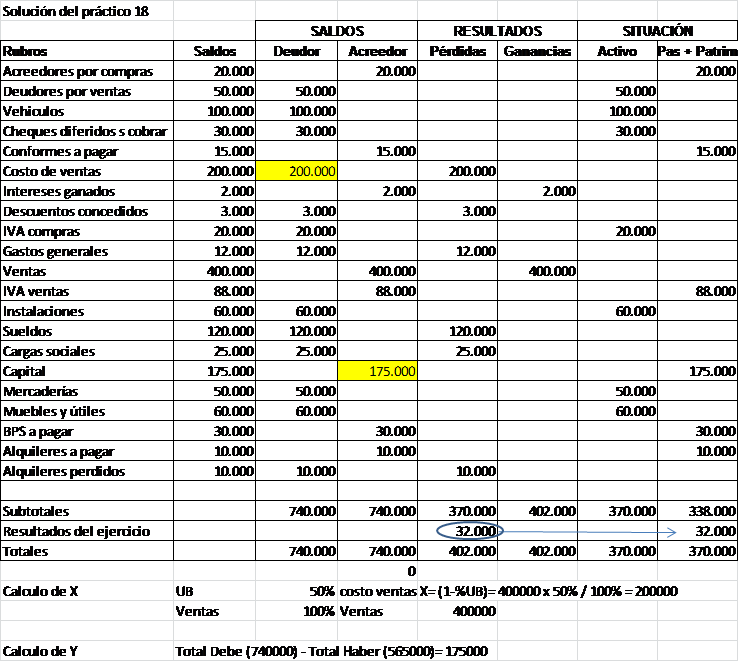

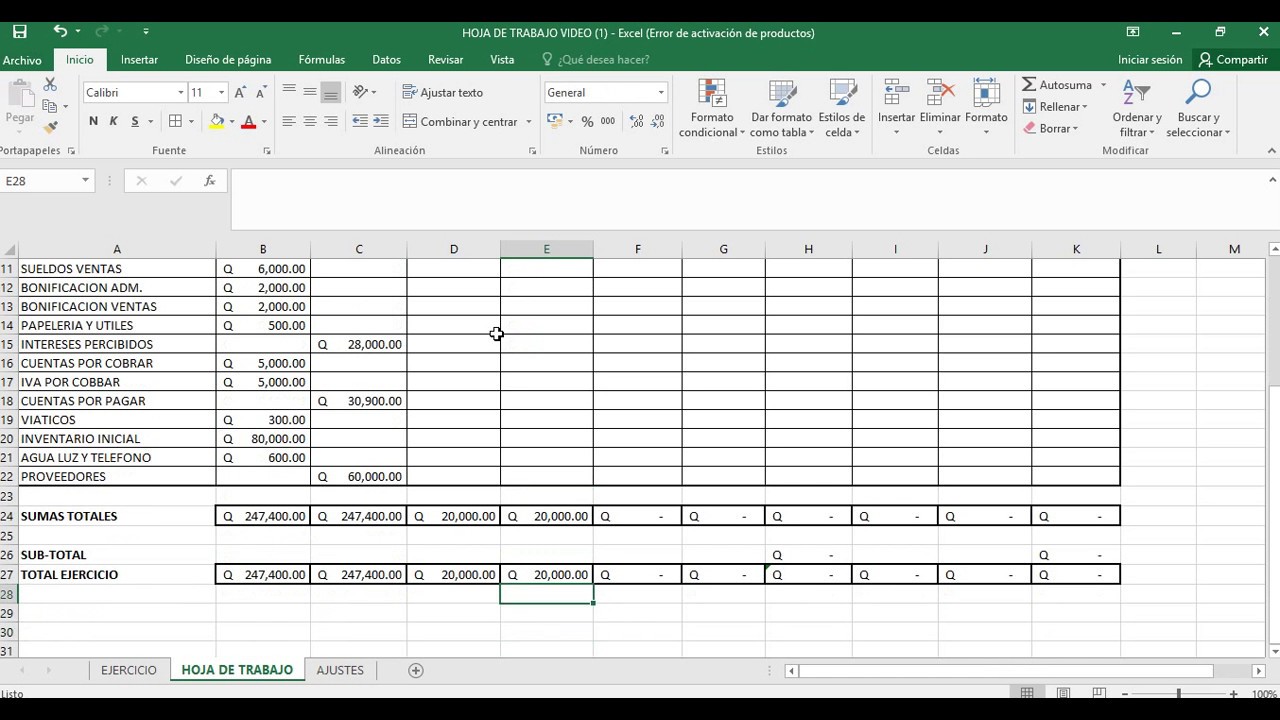

A basic accounting worksheet usually consists of columns for account names, trial balance debits and credits, adjustments, adjusted trial balance, income statement, and balance sheet. Let's take a simplified example: Imagine a small bakery. The trial balance shows sales revenue and expenses like ingredients and rent. An adjustment might be made for prepaid rent, allocating a portion to the current period. This adjustment affects both the income statement (rent expense) and the balance sheet (prepaid rent asset).

Benefits of using accounting worksheets include improved accuracy in financial reporting, easier identification of errors, and a better understanding of the overall financial picture. For instance, a worksheet can highlight discrepancies between expected and actual expenses, allowing a business to investigate and address potential problems. It also provides a snapshot of a company's assets, liabilities, and equity, facilitating informed decision-making regarding investments, loans, and other financial strategies.

Creating a simple worksheet for a small business can start with listing all income and expense accounts. Then, enter the trial balance figures. Next, make any necessary adjustments. Finally, transfer the adjusted balances to the income statement and balance sheet columns. Software like Excel or specialized accounting programs can automate much of this process.

Advantages and Disadvantages of Accounting Worksheets

| Advantages | Disadvantages |

|---|---|

| Improved Accuracy | Potential Complexity |

| Error Detection | Time-Consuming (for large worksheets) |

| Better Financial Overview | Requires Accounting Knowledge |

Frequently Asked Questions:

1. What is an accounting worksheet? (Answer: A tool to organize financial data before finalizing accounts.)

2. Why are accounting worksheets important? (Answer: They improve accuracy and aid in financial analysis.)

3. Who uses accounting worksheets? (Answer: Businesses of all sizes, individuals, and accountants.)

4. How do I create a simple accounting worksheet? (Answer: List accounts, enter trial balance, make adjustments, and transfer to financial statements.)

5. Can I use software for creating accounting worksheets? (Answer: Yes, Excel and accounting software are helpful tools.)

6. What are common issues with accounting worksheets? (Answer: Complexity for large businesses.)

7. How can I learn more about accounting worksheets? (Answer: Online resources, accounting textbooks, and courses are available.)

8. What is the difference between an accounting worksheet and a financial statement? (Answer: A worksheet is a preliminary step; financial statements are the final reports.)

In conclusion, "formato de hoja de trabajo contabilidad," or accounting worksheets, are indispensable tools for anyone seeking financial clarity. From small business owners to large corporations, these structured documents provide a vital step in the accounting process, ensuring accuracy, facilitating analysis, and ultimately, enabling better financial decision-making. Mastering the art of the accounting worksheet is an investment that will pay dividends in terms of financial understanding and control. Start exploring how these powerful tools can transform your financial management today.

Topcon lensmeter ink cartridges get crystal clear prints every time

Unlocking voltas academic legacy a guide to his teaching focus

Real madrid in ea fc 25 a new era of virtual football