Unlocking Abundance: Navigating Wells Fargo Check Limits

Imagine, if you will, a world where financial flow is as effortless as a gentle breeze. Where abundance isn't a distant dream, but a tangible reality, woven into the fabric of your everyday life. Understanding the nuances of your financial tools, like the Wells Fargo personal check limit, is a crucial step in manifesting this vision.

Navigating the world of personal finance can often feel like traversing a dense, overgrown forest. Yet, with the right tools and a touch of mindful intention, you can carve a path toward clarity and financial well-being. One such tool, often overlooked, is the understanding of your check writing limits, specifically with institutions like Wells Fargo.

The Wells Fargo check limit, that seemingly mundane detail, holds a surprising power. It's a gateway to understanding not just the practicalities of your account, but also the deeper potential within your financial landscape. By understanding these limits, you're not just writing checks; you're writing the narrative of your financial future.

This journey of financial exploration isn't about restriction; it's about empowerment. It's about cultivating a conscious relationship with your finances, one that allows you to move with confidence and grace. Understanding the Wells Fargo check limit is not merely a technical detail, it’s a step toward financial liberation.

So, let’s delve into the intricacies of Wells Fargo check limits, unraveling the complexities and revealing the opportunities that lie within. This exploration is an invitation to embrace your financial power and manifest the abundance you deserve. This isn't just about banking; it’s about becoming the architect of your own financial destiny.

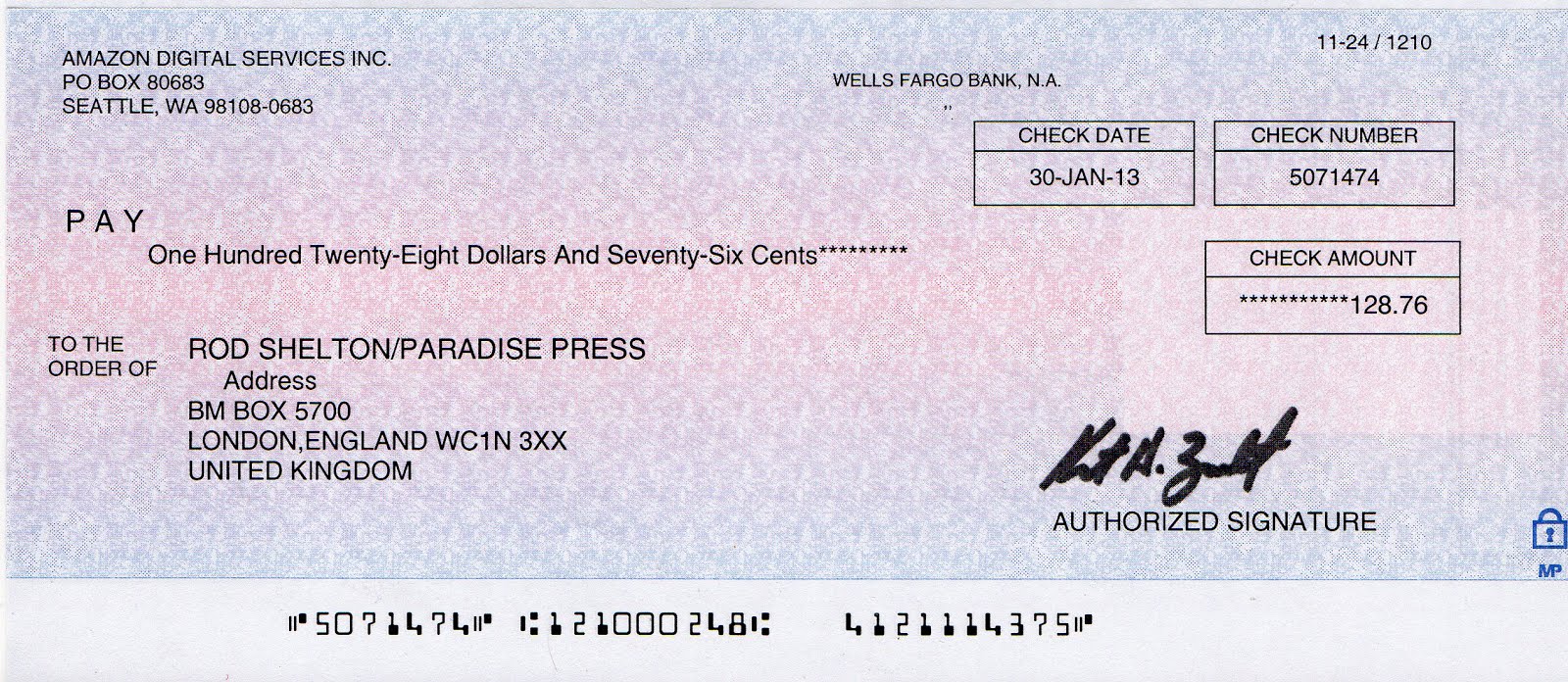

While the precise Wells Fargo personal check cashing limit isn't publicly disclosed and can vary based on factors like account type, history, and individual circumstances, understanding the general principles of check limits is essential. Historically, banks have implemented check limits as a security measure, protecting both the institution and the account holder from potential fraud or overdraft issues. The importance of these limits lies in their ability to provide a framework for responsible financial management.

Consider a scenario where you need to make a substantial purchase, exceeding the standard Wells Fargo check withdrawal limit. One solution might be to arrange a cashier's check or wire transfer directly through the bank. This provides a secure and verifiable method for transferring larger sums.

Let’s explore the potential benefits of understanding your check limits. Firstly, it promotes mindful spending. By being aware of your limits, you’re encouraged to track your expenditures and make conscious decisions about your finances. Secondly, it enhances security. Knowing your limits helps protect you from potential overdrafts and fraudulent activities. Lastly, it fosters a proactive approach to financial management, empowering you to take control of your financial well-being.

Creating a balanced financial ecosystem involves understanding the ebb and flow of your funds. Practical steps include regularly reviewing your account statements, setting up transaction alerts, and communicating directly with Wells Fargo representatives to clarify any questions about your specific check limits.

Advantages and Disadvantages of Check Limits

| Advantages | Disadvantages |

|---|---|

| Increased Security | Potential Inconvenience for Large Transactions |

| Promotes Mindful Spending | May Require Alternative Payment Methods |

Frequently Asked Questions about Check Limits:

1. What is a typical check limit? (Answer: Varies based on individual banks and account types.)

2. How can I find out my specific check limit? (Answer: Contact your bank directly.)

3. What happens if I exceed my check limit? (Answer: May result in declined transactions or overdraft fees.)

4. Can I increase my check limit? (Answer: Potentially, depending on bank policies and account history.)

5. Are cashier's checks subject to the same limits? (Answer: Generally, no, as they are pre-funded.)

6. How can I avoid exceeding my check limit? (Answer: Track your spending and maintain awareness of your account balance.)

7. Are there fees associated with exceeding check limits? (Answer: Potentially, in the form of overdraft fees.)

8. What are the alternatives to writing checks for large amounts? (Answer: Wire transfers, cashier’s checks, or electronic payments.)

One helpful tip for navigating check limits is to establish a clear and consistent budgeting practice. By understanding your spending patterns, you can anticipate larger transactions and plan accordingly, ensuring sufficient funds or exploring alternative payment methods.

In conclusion, navigating the landscape of Wells Fargo check limits is more than just a practical exercise; it’s an opportunity for financial empowerment. By understanding the nuances of your account and embracing mindful financial practices, you can unlock the potential for abundance and create a financial future that aligns with your deepest intentions. Taking the time to explore these seemingly small details can have a profound impact on your overall financial well-being. It allows you to move with greater confidence and clarity, knowing that you're not just managing your finances, but actively shaping your financial destiny. Connect with a Wells Fargo representative today to personalize your understanding and embark on a journey toward financial flourishing.

Unveiling the spectrum exploring pearl colors

Radical spy bowling ball fact fiction and future

Unlocking design with accessible beige undertones