Understanding Western Union Money Exchange Rates

Sending money across borders has become a common necessity in our interconnected world. Whether it's supporting family abroad, paying for international purchases, or managing business transactions, finding a reliable and cost-effective method is crucial. Western Union is a prominent player in the international money transfer market, and understanding their exchange rates is key to making informed decisions.

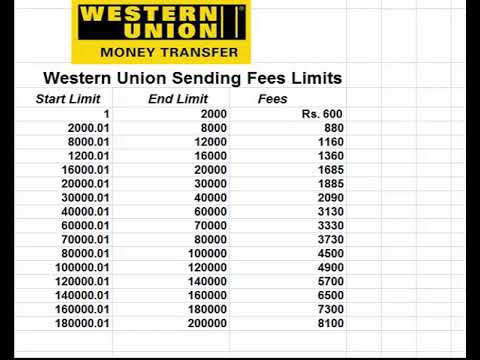

What influences the cost of sending money via Western Union? The Western Union exchange rate is a significant factor. This rate determines how much of the destination currency you'll receive for the money you send. It's essential to understand that Western Union's exchange rate often differs from the mid-market rate (the midpoint between the buy and sell rates on the global currency market). This difference allows Western Union to generate revenue. Therefore, comparing the Western Union rate to the current mid-market rate can give you an idea of the markup involved.

Western Union’s history traces back to 1851 as a telegraph company. Over time, it evolved to offer money transfer services, capitalizing on its established network. Today, it boasts a vast global presence, making it a convenient choice for many. The importance of understanding Western Union's money exchange rate lies in its direct impact on the final amount your recipient receives. A less favorable rate can significantly reduce the amount transferred, particularly for larger sums. One of the main issues surrounding Western Union's exchange rate is its potential lack of transparency. While the rate is generally available, deciphering all the fees and charges associated with the transfer can be challenging.

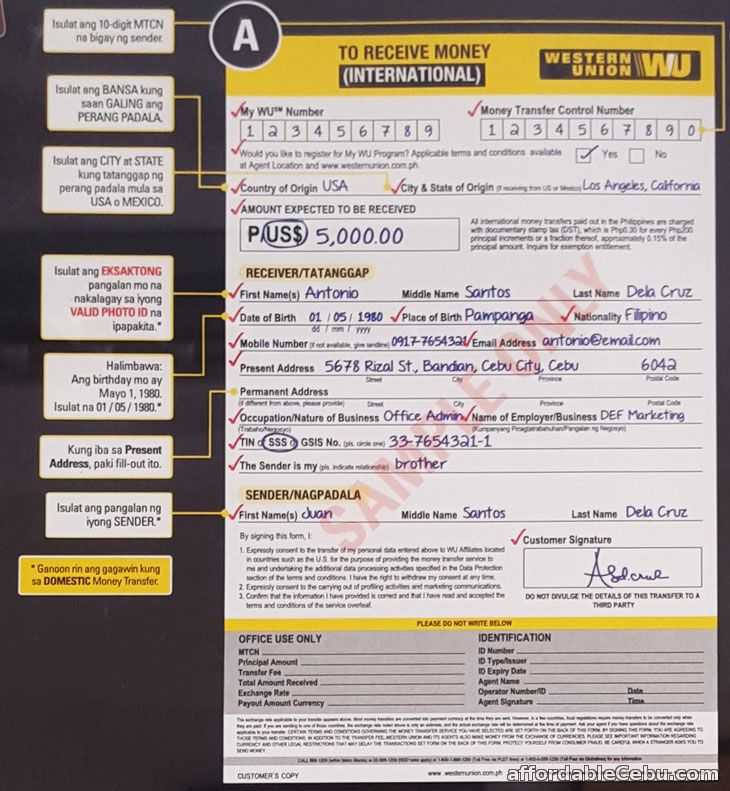

A Western Union money transfer quote typically includes the exchange rate applied and any associated fees. For example, sending $100 USD to Euros might involve an exchange rate of 0.90 EUR/USD and a transfer fee of $5. This means your recipient would receive €85 (after the $5 fee is deducted from the $100 and then converted). Comparing this rate and fee structure to other money transfer services is vital to securing the best value.

Before initiating a transfer with Western Union, clarity on the exchange rate is paramount. The company’s website and app provide real-time quotes, offering transparency regarding the amount your recipient will receive. Factors like the destination country, currency, and transfer method (online, in-person) can influence the applicable exchange rate and fees.

Benefits of using Western Union include its widespread accessibility, with numerous agent locations globally, and its speed, as transfers are often completed quickly. It also offers various transfer methods, catering to different preferences.

Advantages and Disadvantages of Western Union

| Advantages | Disadvantages |

|---|---|

| Widely accessible | Potentially higher fees compared to other services |

| Fast transfer speeds | Exchange rates may be less favorable than the mid-market rate |

| Multiple transfer options | Fee structure can be complex |

Best Practices:

1. Compare exchange rates: Use online tools to compare Western Union's rate with other services.

2. Check fees: Understand all associated fees before initiating the transfer.

3. Consider transfer methods: Online transfers are often cheaper than in-person transactions.

4. Plan ahead: Sending larger amounts less frequently can minimize the impact of fees.

5. Track your transfer: Monitor the progress of your transfer through Western Union’s tracking system.

FAQs:

1. How is the Western Union exchange rate determined? It is influenced by market conditions and Western Union’s pricing structure.

2. Are there hidden fees? While Western Union states its fees upfront, comparing the exchange rate with the mid-market rate can reveal the full cost.

3. Can I lock in an exchange rate? Exchange rates can fluctuate, and typically, you can’t lock in a rate with Western Union.

4. How long does a transfer take? Transfers can be completed within minutes or a few business days depending on the method and destination.

5. What are the payment options? Options include bank transfers, debit cards, and credit cards.

6. How can I track my transfer? Use the tracking number provided by Western Union.

7. What should I do if there's a problem? Contact Western Union customer support.

8. Are there alternatives to Western Union? Yes, services like Wise, Remitly, and MoneyGram are alternatives.

Tips and Tricks: Check for promotional offers and discounts that Western Union occasionally provides. Sending money during off-peak hours may sometimes offer slightly better exchange rates.

In conclusion, understanding the Western Union money exchange rate is crucial for anyone sending money internationally. By comparing rates, being aware of fees, and considering alternative transfer services, you can make informed decisions and maximize the value of your transfers. Western Union provides a convenient and widely accessible service, but being aware of the nuances of their exchange rate structure will ensure you get the most for your money. Remember to compare rates with competitors and consider factors like speed and accessibility when making your choice. Informed decision-making is key to a successful and cost-effective international money transfer experience.

Unlock your inner artist adorable alien drawings made easy

Extend your living space exploring year round patio enclosures

The subtle art of glass painting with benjamin moore