Streamline Your Indonesian Tax Process with NPWP PSD Templates

Are you an individual taxpayer in Indonesia looking to simplify your tax administration? Managing tax paperwork can be a daunting task, but having access to the right resources can make a significant difference. This article explores the advantages of using downloadable NPWP PSD templates for fulfilling your Indonesian tax obligations.

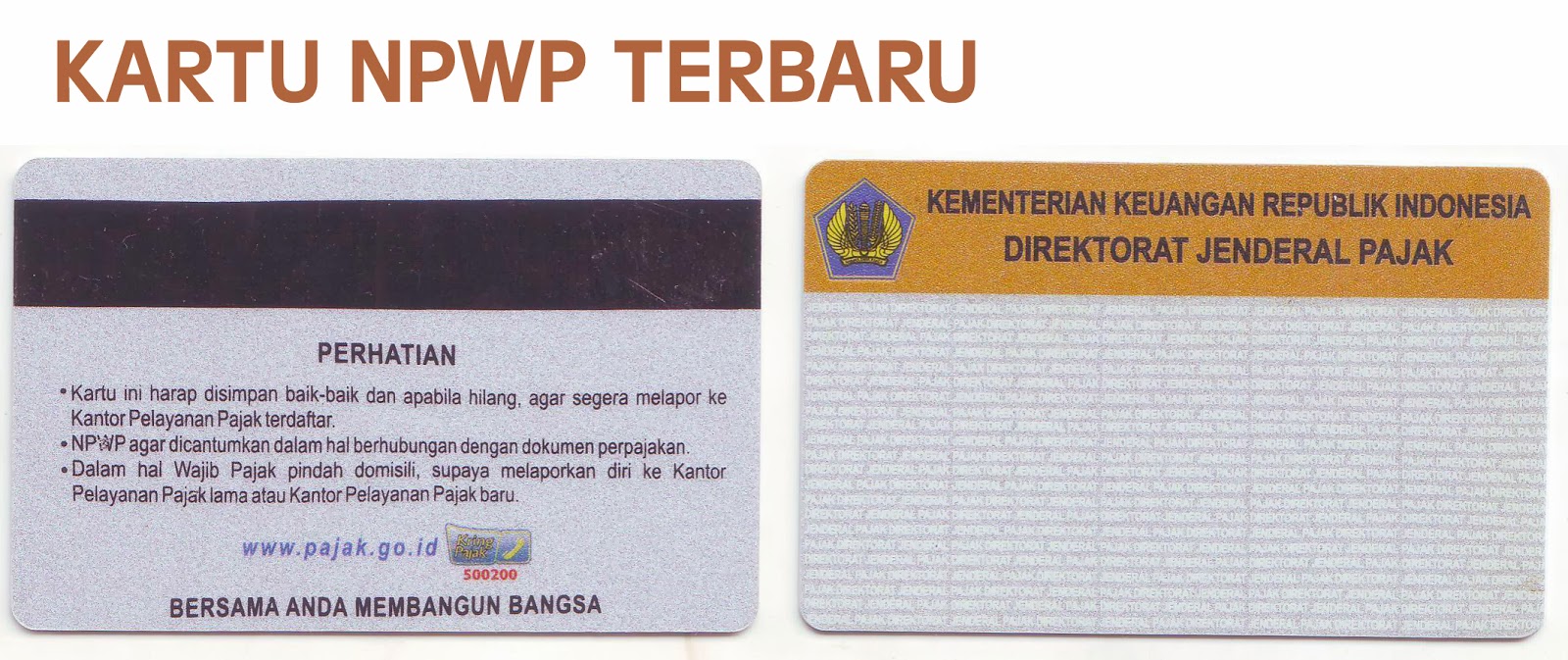

The Nomor Pokok Wajib Pajak (NPWP), or Taxpayer Identification Number, is a crucial requirement for all taxpayers in Indonesia. It's used for various tax-related activities, from filing annual returns to claiming tax refunds. Utilizing a readily available NPWP template, particularly in the adaptable PSD format, can significantly streamline the process of completing and submitting your NPWP forms accurately and efficiently.

The Indonesian tax system can be complex, and ensuring accurate completion of tax forms is essential. Downloadable NPWP PSD templates offer a practical solution to this challenge. These templates provide a pre-designed layout for the NPWP form, including all the necessary fields and sections. By using a template, you can minimize errors and ensure that all required information is provided in the correct format, reducing the risk of delays or rejections.

Finding reliable and accessible NPWP PSD templates is crucial. While various resources might offer these templates, ensuring their legitimacy and accuracy is paramount. Official government websites and reputable tax consultant platforms are often the best sources for obtaining trustworthy NPWP PSD templates. It's crucial to verify the source of the template to avoid using outdated or incorrect versions.

The emergence of downloadable NPWP templates has greatly simplified tax compliance for many individuals in Indonesia. Before these readily available templates, individuals often had to manually fill out physical forms, which was a time-consuming and error-prone process. The availability of digital templates, especially in the versatile PSD format, has allowed taxpayers to complete and submit their NPWP information more efficiently and accurately.

A major issue related to downloading NPWP PSD templates is the potential for encountering outdated or inaccurate versions. It's crucial to verify the source and ensure that the template aligns with current tax regulations. Using an incorrect template could lead to errors in your tax filing and potential complications with tax authorities.

An NPWP PSD template is a pre-designed digital file, typically in Adobe Photoshop format, that provides a framework for completing the NPWP registration or update form. It includes all the necessary fields and sections, allowing users to easily input their information digitally. For example, a template might include fields for your name, address, date of birth, and other required details.

Benefits of using NPWP PSD templates include time savings due to pre-filled fields, reduced errors thanks to structured layouts, and increased accuracy as the templates often incorporate current regulations.

To effectively utilize an NPWP PSD template, start by downloading the template from a reliable source. Next, open the file using compatible software like Adobe Photoshop. Fill in the required information accurately, review for errors, and finally, save and submit as instructed by the tax authorities.

Before submitting your completed NPWP form based on a PSD template, ensure you double-check all information for accuracy. Verify that your personal details, tax information, and any other required fields are correctly filled. Using a checklist can be helpful to ensure all essential components are completed.

Advantages and Disadvantages of Using NPWP PSD Templates

| Advantages | Disadvantages |

|---|---|

| Time-saving | Requires compatible software (e.g., Photoshop) |

| Reduces errors | Risk of using outdated templates if not sourced carefully |

| Improved accuracy | Potential for compatibility issues across different software versions |

Best practices include downloading from official sources, verifying the template's currency, using the correct software, backing up your filled form, and confirming submission requirements with tax authorities.

Real-world examples could include freelancers using the template to register for an NPWP, business owners updating their NPWP information, or tax consultants utilizing templates to assist their clients.

Challenges might include software compatibility issues, difficulty finding updated templates, or uncertainty about specific field requirements. Solutions involve using alternative software, consulting tax authorities for updated templates, and seeking professional assistance.

FAQs might cover where to download templates, what software to use, how to handle errors, who to contact for support, and more.

Tips and tricks include regular software updates, keeping a copy of the filled template, and seeking professional advice when needed.

In conclusion, downloadable NPWP PSD templates provide a valuable resource for simplifying Indonesian tax compliance. By utilizing these templates, taxpayers can save time, reduce errors, and ensure accuracy in their tax filings. Remember to source your templates from reputable sources, double-check all information before submission, and stay updated with any changes in tax regulations. Taking advantage of these readily available resources can greatly enhance your tax management experience and contribute to a smoother tax process. Leveraging accessible tools like NPWP PSD templates empowers individuals to efficiently manage their tax obligations while minimizing potential complications. Start streamlining your Indonesian tax process today by exploring available NPWP PSD templates and ensuring your tax compliance is handled accurately and efficiently.

Lee slim fit bootcut jeans mens ultimate guide

Unlocking savings your guide to mcarthurglen designer outlet perks

Conquer the california dmv test your guide to success