Stopping Payment: The Definitive Guide to Cheque Cancellation Letters

In today's fast-paced digital world, cheques might seem like relics of the past. Yet, they still hold relevance in various financial transactions. What happens when you need to stop a cheque payment? A cheque cancellation letter becomes your essential tool. This comprehensive guide dives deep into the world of cheque stop payment requests, providing you with everything you need to know to navigate this process effectively.

Imagine accidentally writing a cheque with the wrong amount or needing to halt a payment due to a dispute with a vendor. Requesting a cheque cancellation becomes crucial in such scenarios. A formal letter to your bank acts as an official instruction to stop the cheque from being processed, preventing potential financial losses and complications.

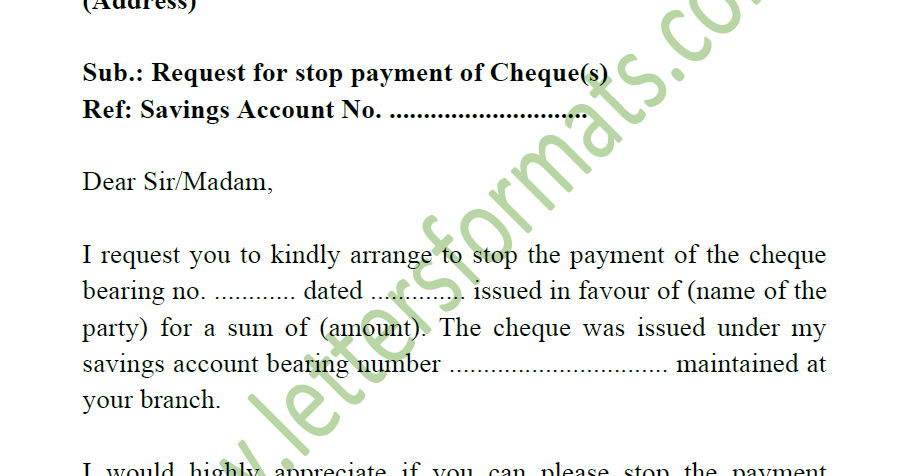

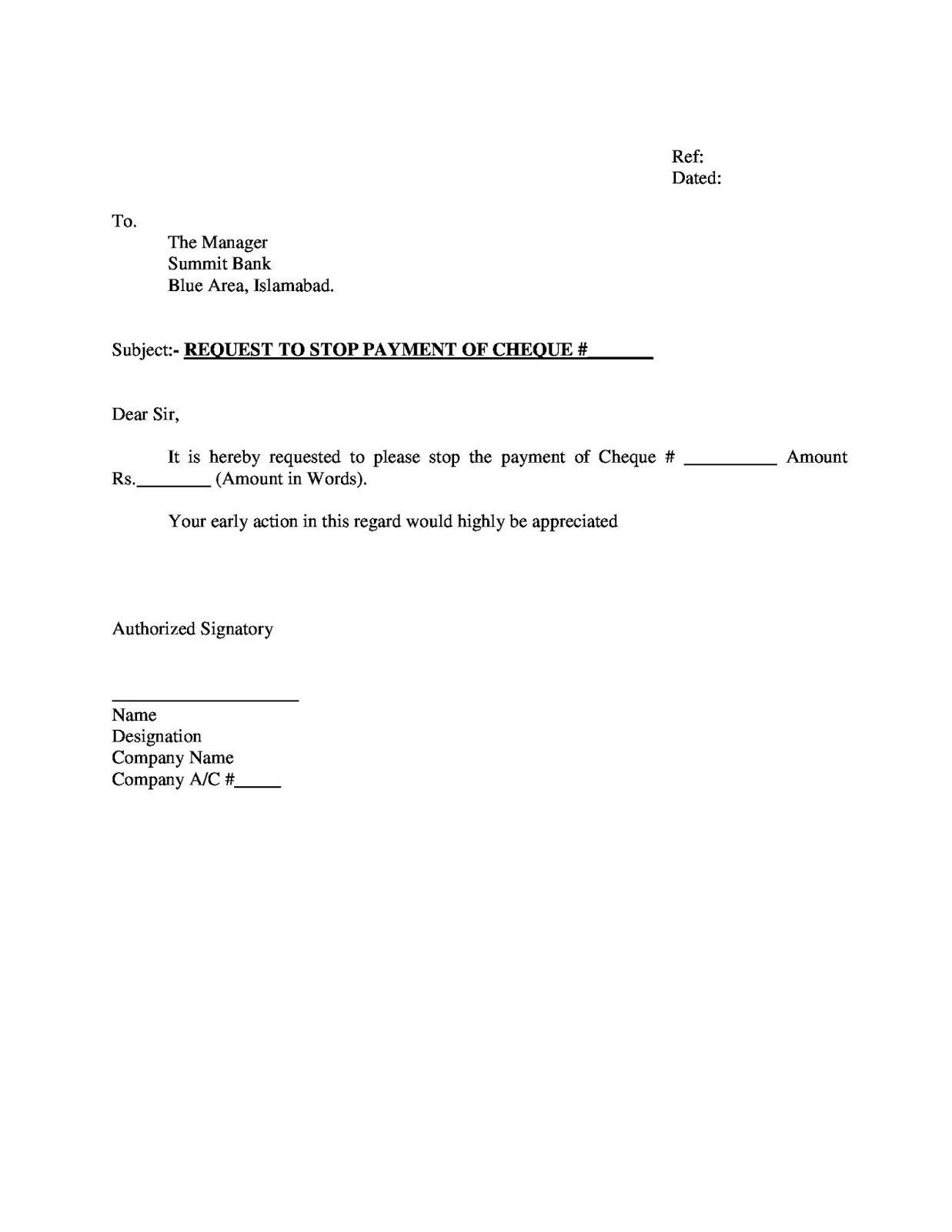

Writing a cheque stop payment request isn't just about scribbling a note; it involves a specific format and crucial details to ensure your request is processed promptly and accurately. This guide will explore the key elements of a robust cancellation request, including essential information like the cheque number, date, amount, payee name, and your account details. We'll delve into the importance of clear and concise language, ensuring your request leaves no room for misinterpretation.

A cheque cancellation request letter, also known as a stop payment request, serves as a formal communication to your bank instructing them to prevent a specific cheque from being cashed or cleared. This process is essential for protecting your funds and resolving potential issues with incorrect payments, disputes, or lost cheques.

While the digital age has brought alternative payment methods, cheques still hold relevance in certain transactions. Consequently, understanding the process of cheque cancellation remains vital for managing your finances effectively. A well-crafted cancellation letter ensures a smooth process, minimizing potential complications and providing peace of mind.

Historically, stopping a cheque required a physical visit to the bank. However, with advancements in communication, written letters became the preferred method, providing a documented record of the request. Today, online banking and mobile apps offer convenient alternatives, but understanding the fundamental principles of a formal letter remains essential.

One key issue with cheque cancellation requests is the time sensitivity. Acting swiftly is crucial, as the bank needs sufficient time to process the request before the cheque is presented for payment. Another challenge lies in providing accurate information. Any discrepancies in the details can lead to delays or even rejection of the request.

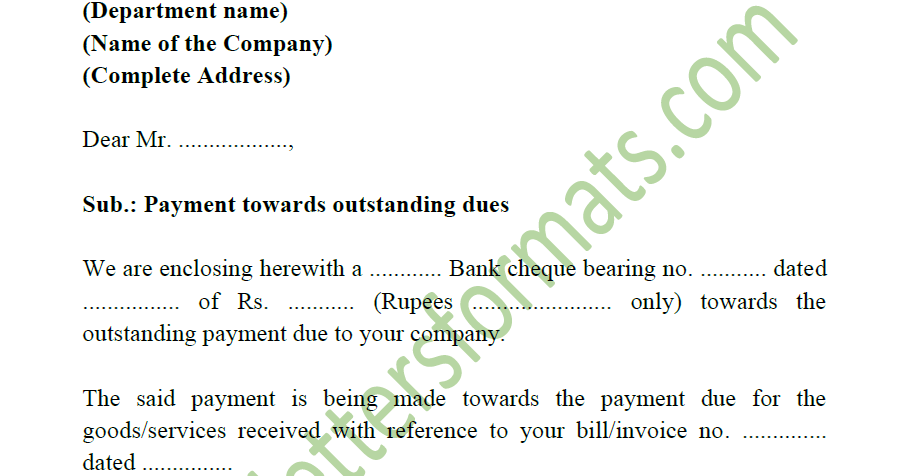

A sample stop payment request letter typically includes the date, your address, the bank's address, your account details, the cheque number, date, amount, and the payee's name. A clear statement requesting the bank to stop payment on the specified cheque is crucial.

Benefits of a formal cheque cancellation letter include: 1) Preventing financial loss from incorrect or fraudulent cheques, 2) Resolving payment disputes effectively, and 3) Providing a documented record of your request for future reference.

To cancel a cheque, gather your account details, the cheque information, and contact your bank. You can submit the request in writing, through online banking, or via a phone call, depending on your bank's policies.

Advantages and Disadvantages of Cheque Cancellation Letters

| Advantages | Disadvantages |

|---|---|

| Provides a formal record | Can be time-sensitive |

| Protects against financial loss | Requires accurate information |

| Resolves payment disputes | May involve fees |

Best Practices: 1) Act quickly, 2) Provide accurate information, 3) Keep a copy of the letter, 4) Follow up with your bank, 5) Understand your bank’s policies regarding stop payment requests.

FAQs:

1. How long does a cheque stop payment request last? (Answer: Varies by bank.)

2. Can I cancel a cheque online? (Answer: Depends on your bank.)

3. Is there a fee for stopping a cheque payment? (Answer: Often, yes.)

4. What if the cheque has already been cashed? (Answer: Contact your bank immediately.)

5. How can I track the status of my stop payment request? (Answer: Contact your bank or check online banking.)

6. What happens if I provide incorrect information in the letter? (Answer: The request may be delayed or rejected.)

7. Can I stop payment on a certified cheque? (Answer: It's more complex; contact your bank.)

8. What should I do if I lose a cheque? (Answer: Request a stop payment immediately.)

Tips and Tricks: Always double-check the cheque details before submitting the request. Keep a record of all communication with your bank regarding the stop payment.

In conclusion, a cheque cancellation letter remains a critical tool in managing your finances, even in today's digital age. Understanding the nuances of crafting a clear and concise request, acting promptly, and providing accurate information are crucial for successful cheque cancellation. By following the best practices outlined in this guide, you can effectively protect yourself from potential financial losses and maintain control over your funds. The ability to stop a cheque payment provides peace of mind and empowers you to navigate financial transactions with confidence. Take the time to familiarize yourself with your bank's specific procedures and fees associated with stop payment requests. This proactive approach will enable you to act swiftly and decisively when the need arises, ensuring your financial security and minimizing potential disruptions.

Finding solace navigating funeral services in canton ohio

Hack your bathroom bliss unleashing the power of sage green

Fifa 23 team of the year honorable mentions snubs and debates