Ocean City, NJ Property Tax: A Deep Dive

Ocean City, New Jersey, evokes images of sun-drenched beaches, charming boardwalks, and a vibrant community. But beneath the surface of this idyllic seaside haven lies a complex financial ecosystem, powered in part by property taxes. Understanding the ebb and flow of Ocean City's property tax system is crucial for both current residents and those considering making this coastal paradise their home.

Property taxes in Ocean City, NJ, represent a significant financial commitment for homeowners. These levies are the lifeblood of the city's operational budget, funding essential services that contribute to the high quality of life enjoyed by residents. From maintaining pristine beaches and bustling boardwalks to supporting top-tier schools and public safety initiatives, property taxes play a vital role in shaping the Ocean City experience.

The historical context of Ocean City's property tax structure is rich and nuanced. Over time, these levies have evolved to reflect the city's growth and changing needs. Understanding this historical trajectory can provide valuable insights into the current system and its potential future direction. Analyzing the historical impact of property tax adjustments can shed light on their ripple effects within the local economy and community.

Navigating the complexities of Ocean City property taxes can feel daunting. However, by breaking down the system into its core components, we can demystify the process. From assessed property values and millage rates to exemptions and payment schedules, gaining clarity on these key elements empowers homeowners to make informed decisions.

Delving deeper into the world of Ocean City, NJ, property taxes unveils a fascinating interplay of factors that influence these financial obligations. Unraveling these intricacies can empower residents to optimize their financial planning and maximize the benefits they receive from the city's services.

The revenue generated by Ocean City property taxes directly impacts the city's ability to maintain its infrastructure, provide essential services, and preserve its unique character. Funding public schools, ensuring public safety, and preserving the beautiful beaches are just a few examples of how these taxes contribute to the overall well-being of the community.

The Ocean City Tax Assessor determines the assessed value of each property, which serves as the basis for calculating property taxes. The tax rate, expressed as a millage rate, is then applied to the assessed value to determine the tax liability.

One benefit of paying Ocean City, NJ property taxes is the direct contribution to excellent public schools. Another benefit is the maintenance of the city's pristine beaches and public spaces. Furthermore, these taxes support essential public safety services.

Advantages and Disadvantages of Ocean City, NJ Property Tax

| Advantages | Disadvantages |

|---|---|

| Funds essential city services | Can be a significant financial burden |

| Supports high-quality schools | Property values can fluctuate, impacting taxes |

| Maintains attractive public spaces | Tax rates can be subject to change |

Best practices for managing Ocean City, NJ property taxes include understanding your assessment, exploring potential exemptions, paying taxes on time to avoid penalties, and engaging with local resources for assistance.

Frequently Asked Questions about Ocean City, NJ Property Taxes:

1. How is my property assessed? Answer: The Ocean City Tax Assessor determines property values based on various factors.

2. What are the tax payment deadlines? Answer: Check the Ocean City Tax Collector's office for specific dates.

3. Are there any tax exemptions available? Answer: Certain exemptions may apply; consult with local authorities.

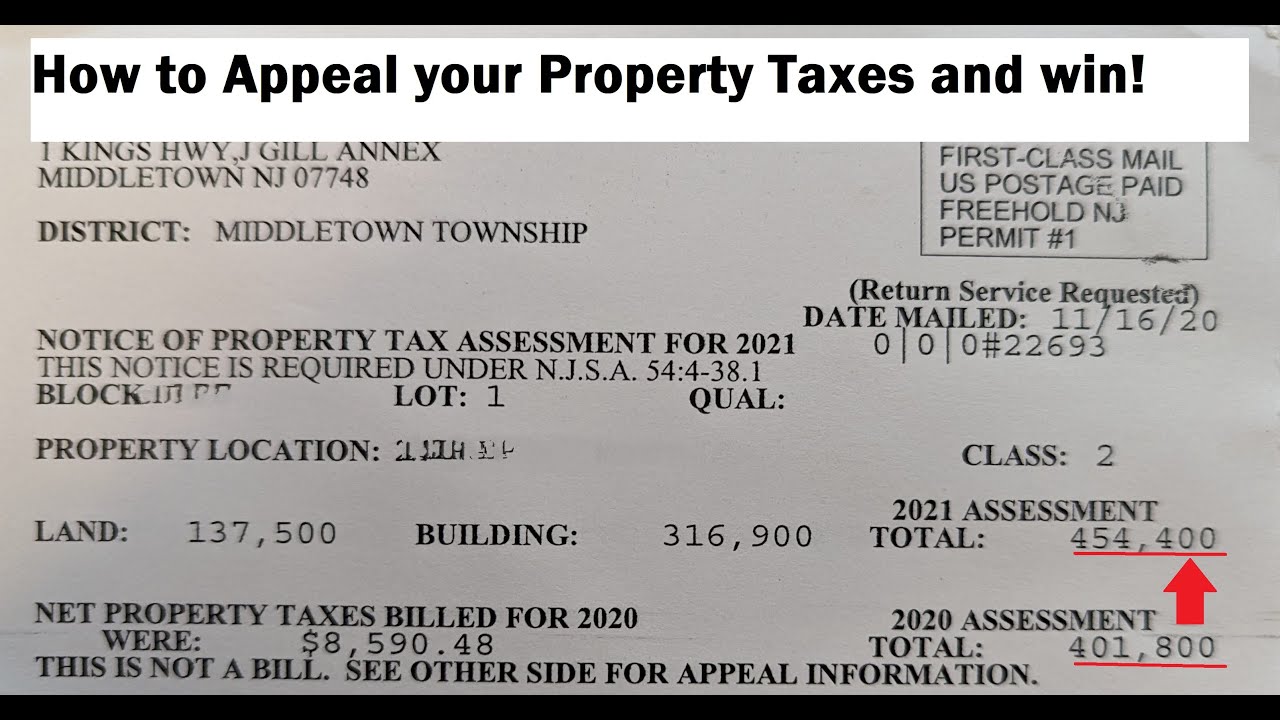

4. How can I appeal my property assessment? Answer: There is a formal appeals process.

5. Where can I find more information about property taxes? Answer: The Ocean City website offers detailed information.

6. How are property taxes used in Ocean City? Answer: Primarily to fund municipal services and schools.

7. What is the current millage rate? Answer: Contact the tax assessor's office for the current rate.

8. How can I calculate my property tax liability? Answer: Multiply the assessed value by the millage rate.

Tips for navigating Ocean City, NJ property taxes include keeping accurate records, staying informed about changes in tax rates or assessments, and consulting with a financial advisor if needed.

In conclusion, Ocean City, NJ property taxes are a crucial element of sustaining the city's vibrant community and exceptional quality of life. By understanding the intricacies of this system, residents can make informed decisions about their financial obligations and appreciate the value these taxes bring to their beloved seaside community. Navigating the property tax landscape may seem complex, but the resources available to homeowners and prospective buyers can simplify the process. Taking proactive steps to understand your property tax obligations empowers you to fully embrace the Ocean City experience, from its beautiful beaches to its thriving local businesses, all while ensuring a secure and prosperous future for this coastal gem. Understanding and engaging with the nuances of property taxes in Ocean City, NJ allows residents to contribute to the ongoing vitality of this cherished community.

Bmw m3 g80 gloss black front grille transform your ride

Finding the perfect 13 lb bowling ball for women

Unlocking the secrets of the millet man and his hoe