Navigating the Landscape of Humana Medicare Rx Prescription Drug Plans

In the labyrinth of modern healthcare, securing affordable and comprehensive prescription drug coverage stands as a paramount concern, particularly for those navigating the complexities of Medicare. How do we discern the most effective path through the myriad options available? For many, Humana Medicare Rx prescription drug plans offer a potential solution. But what does this coverage truly entail, and how can we harness its potential to optimize our health and well-being?

Humana, a prominent player in the health insurance arena, provides a range of Medicare Part D prescription drug plans designed to complement Original Medicare. These plans aim to alleviate the financial burden of prescription medications, enabling beneficiaries to access essential treatments without incurring exorbitant out-of-pocket expenses. Understanding the nuances of Humana's offerings is crucial for making informed decisions about one's healthcare journey.

The emergence of Medicare Part D prescription drug coverage represents a significant milestone in healthcare accessibility. Prior to its implementation in 2006, many Medicare beneficiaries struggled to afford necessary medications, leading to compromised health outcomes. Humana's participation in this program reflects a broader societal shift towards recognizing the importance of affordable pharmaceutical access for all.

Navigating the landscape of Humana Medicare Rx plans requires a nuanced understanding of various plan types, formularies (lists of covered drugs), and cost-sharing structures. One of the central challenges revolves around selecting a plan that aligns with an individual's specific medication needs and budgetary constraints. Factors such as premiums, deductibles, co-pays, and coverage gaps (the "donut hole") must be carefully considered.

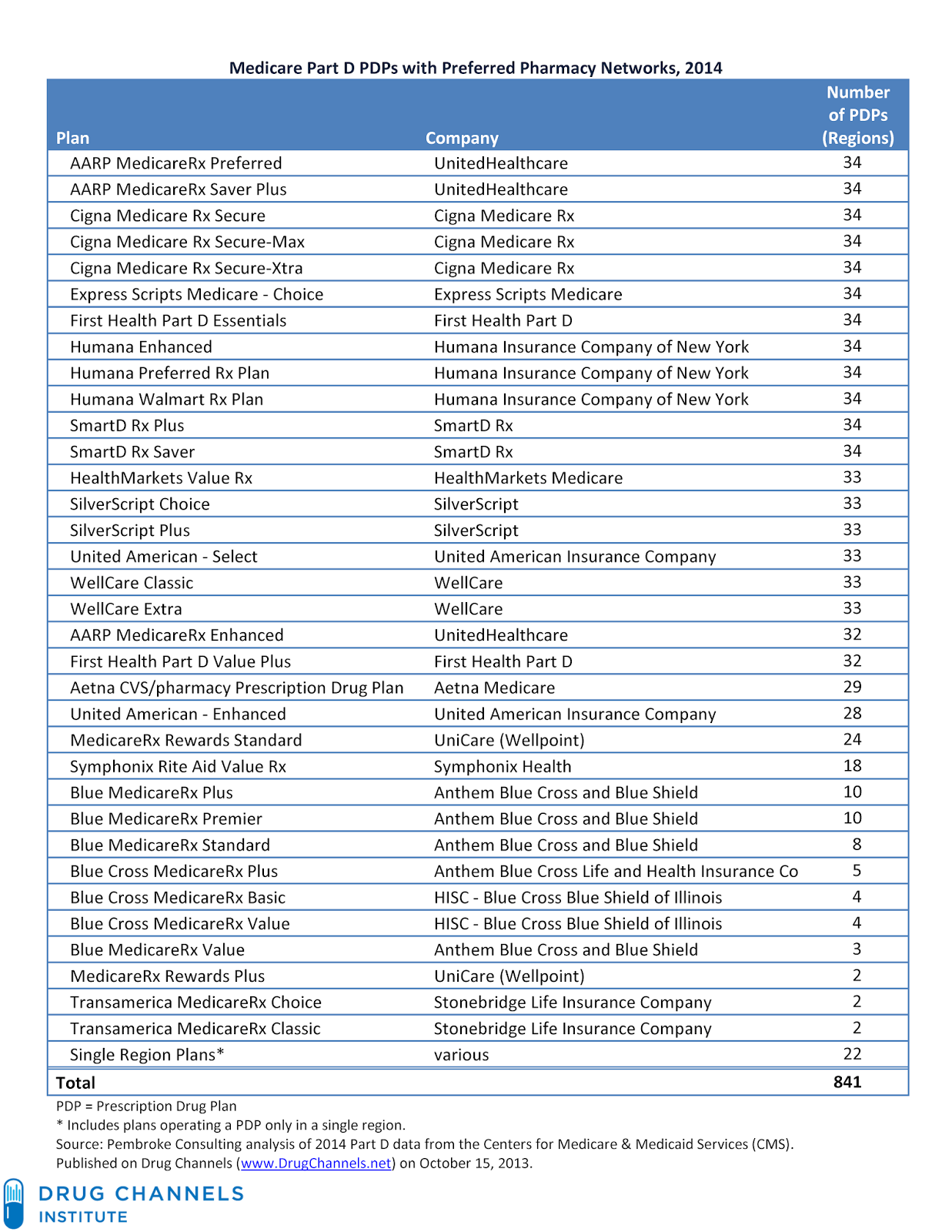

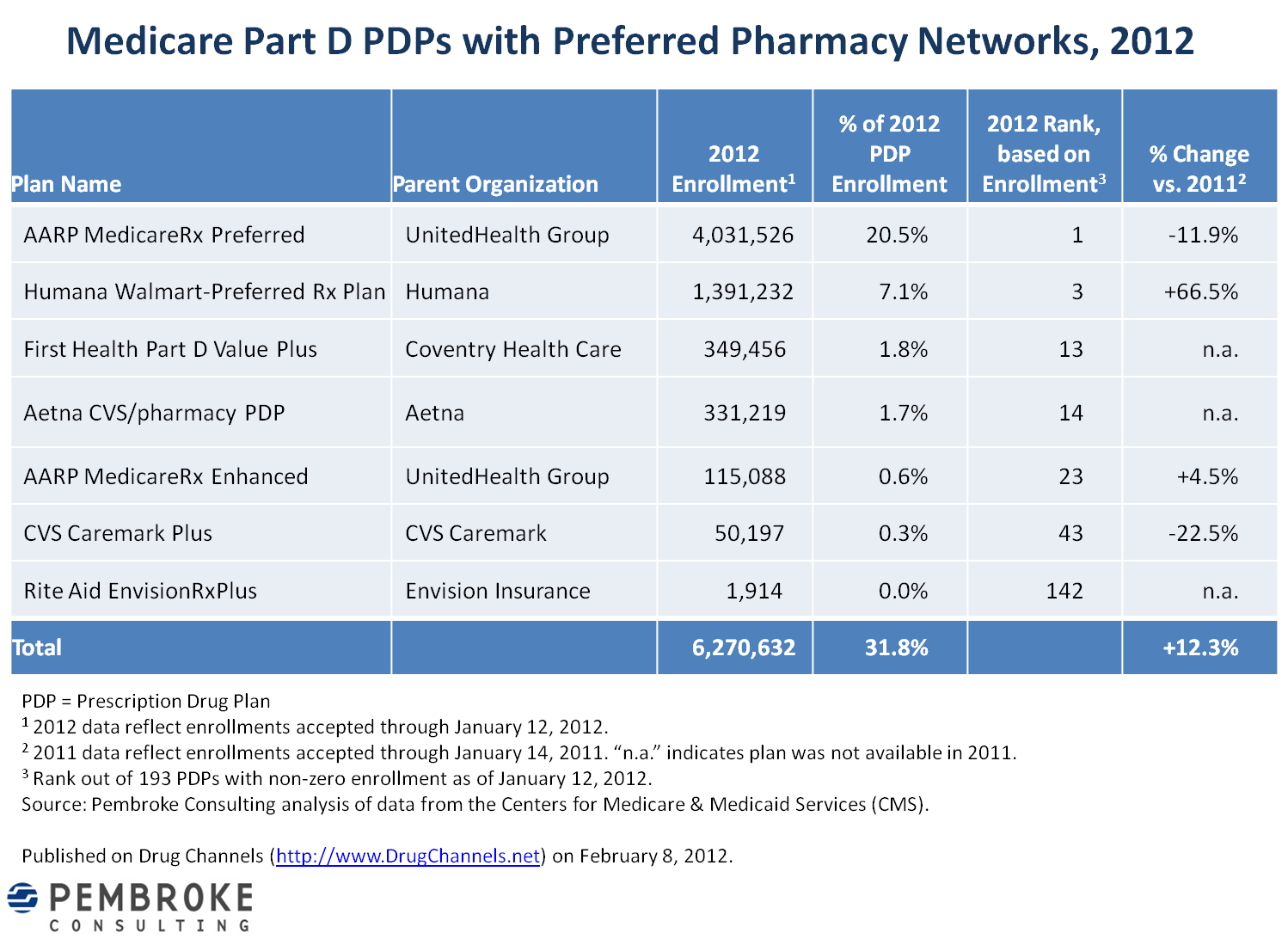

Humana offers a spectrum of Medicare Rx prescription drug plans, each with its own unique features and benefits. Some plans offer preferred pharmacy networks, which can provide lower costs for filling prescriptions at specific pharmacies. Others cater to individuals with chronic conditions by offering specialized formularies tailored to their medication requirements. Comparing these options is essential for finding the optimal fit.

One key benefit of Humana Medicare Rx plans is the potential for significant cost savings on prescription drugs. By negotiating discounted rates with pharmaceutical manufacturers, Humana helps reduce the financial strain on beneficiaries. Additionally, some plans offer extra help for low-income individuals, further enhancing affordability.

Another advantage lies in the convenience of coordinating prescription drug coverage with other Humana Medicare plans, such as Medicare Advantage. This streamlined approach simplifies healthcare management by consolidating coverage under one umbrella.

Furthermore, Humana's online resources and customer support services provide valuable assistance in navigating the complexities of Medicare Rx plans. Beneficiaries can access plan information, formularies, and cost estimators online, empowering them to make informed choices.

Advantages and Disadvantages of Humana Medicare Rx Prescription Drug Coverage

| Advantages | Disadvantages |

|---|---|

| Potential cost savings on prescription drugs | Plan formularies may not cover all medications |

| Convenience of coordinated coverage with other Humana plans | Network restrictions may limit pharmacy choices |

| Online resources and customer support | Cost-sharing structures can be complex |

Choosing the right Humana Medicare Rx plan involves carefully assessing individual medication needs, comparing plan costs and benefits, and considering factors like preferred pharmacies and network restrictions. Consulting with a licensed insurance agent can provide personalized guidance in this decision-making process.

Frequently Asked Questions about Humana Medicare Rx Prescription Drug Coverage:

1. What is the difference between a standalone Part D plan and a Medicare Advantage plan with prescription drug coverage?

2. How do I determine which Humana Medicare Rx plan is right for me?

3. What is the coverage gap (donut hole), and how does it affect my costs?

4. Can I change my Humana Medicare Rx plan during the year?

5. What resources are available to help me understand my plan's formulary?

6. How do I find a preferred pharmacy in my network?

7. What assistance is available for low-income beneficiaries?

8. How do I contact Humana customer service for assistance with my prescription drug coverage?

(Provide general answers to each question)

Tips for managing your Humana Medicare Rx prescription drug coverage: Review your plan's formulary regularly, utilize mail-order pharmacy options for cost savings, and explore manufacturer co-pay assistance programs.

In the tapestry of healthcare choices, securing affordable and comprehensive prescription drug coverage is a thread of paramount importance. Humana Medicare Rx prescription drug plans offer a pathway to navigate the complexities of medication management, providing a range of options designed to meet diverse needs and budgets. By diligently exploring these options, understanding plan benefits and limitations, and actively engaging in informed decision-making, we empower ourselves to optimize our health and well-being, ensuring access to the essential medications that sustain and enhance our lives. Engaging with Humana's resources, consulting with healthcare professionals, and staying informed about changes in coverage are crucial steps in maximizing the potential of Humana Medicare Rx prescription drug plans and securing a healthier future. Remember, proactive engagement in your healthcare choices is an investment in your overall well-being. Take the time to research, compare, and choose the plan that best aligns with your unique circumstances, empowering yourself to live a healthier, more fulfilling life.

Elevate your online aura with anime profile pictures

Marine ac control panels keeping you cool out on the waves

The vital world of local industrial control systems