Mastering Your Finances: A Guide to Creating a Spreadsheet (Hoja de Contabilidad)

Are you ready to take control of your finances? Whether you're managing a household budget, tracking business expenses, or planning for future investments, a well-structured spreadsheet (or "hoja de contabilidad" in Spanish) can be your most powerful tool. This guide will equip you with the knowledge and skills to build and utilize a spreadsheet effectively, transforming your financial management from a daunting task into a streamlined process.

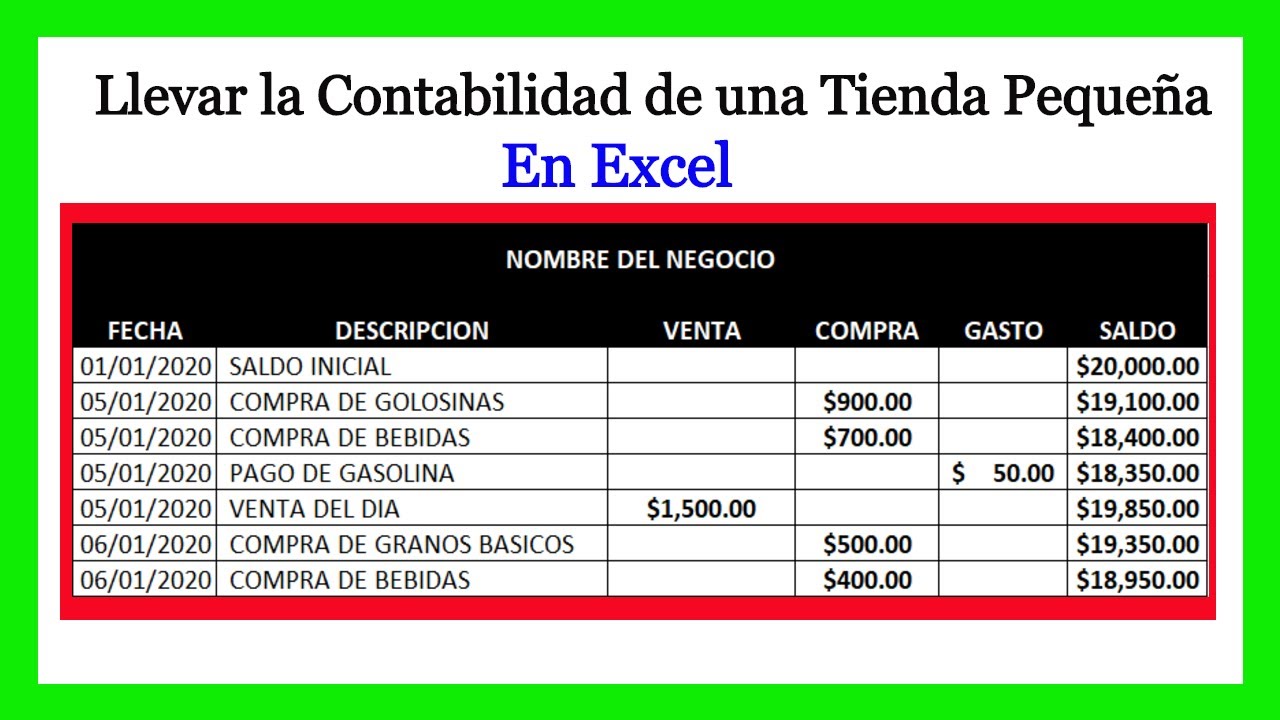

Creating a "hoja de contabilidad," essentially translating to "accounting sheet" or "spreadsheet," is a fundamental practice in financial management. It allows individuals and businesses to organize income and expenses, track financial performance, and make informed decisions. This seemingly simple tool can have a profound impact on your financial well-being, offering clarity and control over your monetary flow.

The history of structured financial record-keeping dates back centuries, evolving from manual ledgers to digital spreadsheets. The advent of spreadsheet software revolutionized the way we manage finances, automating calculations and enabling dynamic analysis. The importance of this organized approach lies in its ability to provide a clear picture of your financial health, facilitating better budgeting, forecasting, and decision-making.

One of the main issues surrounding spreadsheet creation is the initial hurdle of setting it up correctly. Many people are intimidated by the perceived complexity of spreadsheet software. This guide will break down the process into manageable steps, making it accessible to everyone regardless of their prior experience. We will address common challenges and offer practical solutions to ensure you can build a spreadsheet that meets your specific needs.

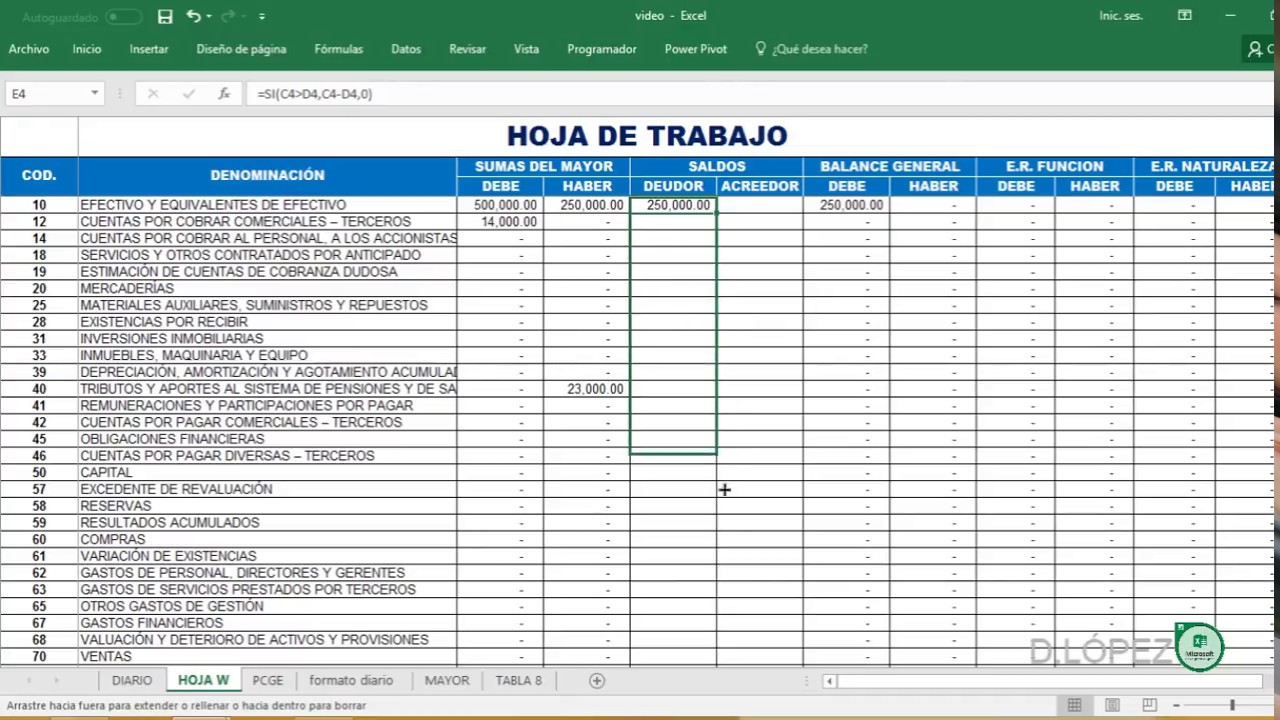

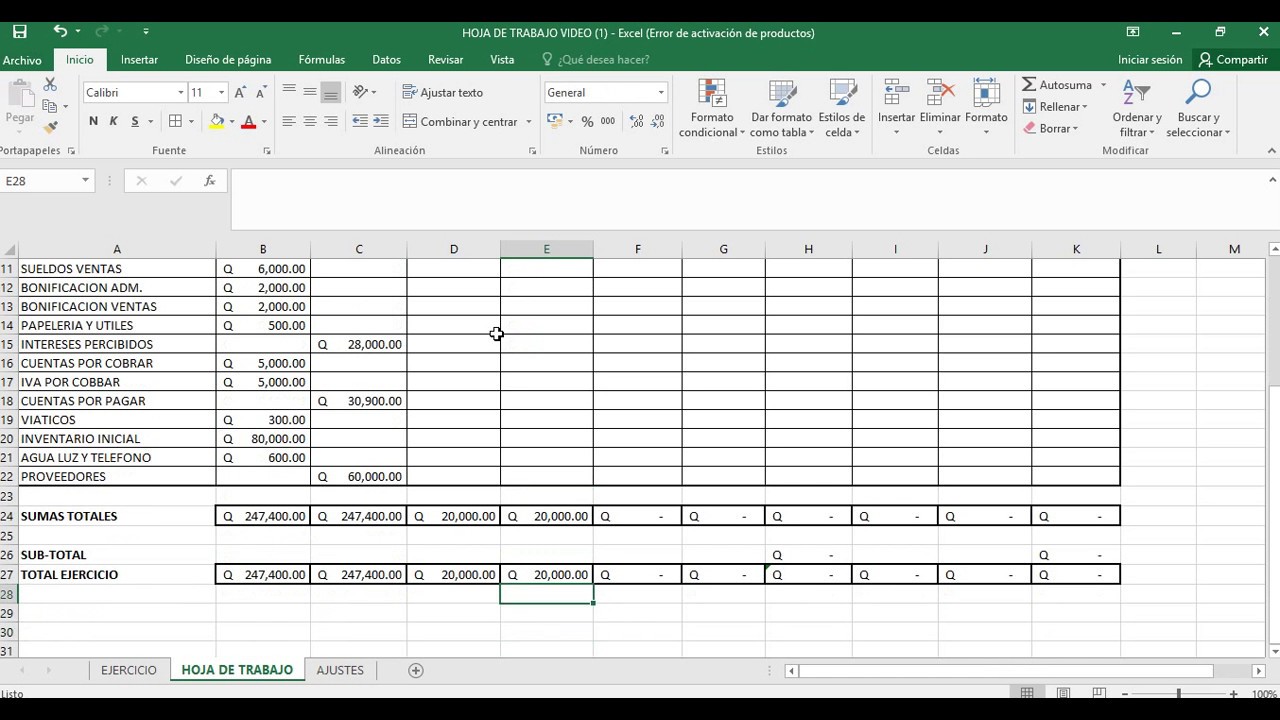

At its core, a spreadsheet is a grid of cells organized into rows and columns. Each cell can contain data, formulas, or labels. For example, you might use columns to represent different expense categories (rent, groceries, utilities) and rows to represent different time periods (months, quarters, years). Formulas can then be used to automatically calculate totals, averages, and other relevant metrics. This structured approach allows for easy data entry, analysis, and reporting.

One benefit of using a spreadsheet is improved budgeting. By tracking your income and expenses, you can gain a clear understanding of where your money is going and identify areas where you can save. A spreadsheet can also help you create and stick to a budget, ensuring you meet your financial goals.

Another benefit is enhanced financial planning. A spreadsheet can be used to project future income and expenses, allowing you to make informed decisions about investments, savings, and major purchases. This foresight empowers you to plan for the future with confidence.

Accurate financial reporting is another key advantage. Spreadsheets can generate reports that summarize your financial performance over different time periods. These reports can be invaluable for tax preparation, business planning, and investment analysis.

To create your own spreadsheet, start by choosing a spreadsheet program (like Google Sheets or Microsoft Excel). Then, label your columns with expense categories and your rows with time periods. Input your income and expense data and use formulas to calculate totals and other relevant metrics. Regularly update your spreadsheet to keep track of your financial activity.

Advantages and Disadvantages of Using a Spreadsheet

| Advantages | Disadvantages |

|---|---|

| Improved Budgeting | Potential for Errors |

| Enhanced Financial Planning | Can be Time-Consuming |

| Accurate Financial Reporting | Limited Collaboration Features (depending on the software) |

FAQ:

1. What is a spreadsheet?

A spreadsheet is a digital document that organizes data in rows and columns.

2. How do I create a spreadsheet?

You can create a spreadsheet using software like Google Sheets or Microsoft Excel.

3. What are formulas?

Formulas are equations that perform calculations on spreadsheet data.

4. How can a spreadsheet help with budgeting?

Spreadsheets help track income and expenses, allowing for better budget management.

5. What are some common spreadsheet errors?

Common errors include incorrect formulas, data entry mistakes, and inconsistent formatting.

6. How can I protect my spreadsheet data?

Use strong passwords and consider cloud storage with version history.

7. Can I share my spreadsheet with others?

Yes, many spreadsheet programs offer collaboration features.

8. Where can I learn more about spreadsheets?

Online tutorials and courses are great resources for learning more.

In conclusion, creating and maintaining a "hoja de contabilidad" – a spreadsheet – is an essential skill for effective financial management. From personal budgeting to complex business accounting, the benefits of utilizing a spreadsheet are undeniable. It empowers you to track income and expenses, plan for the future, and make informed financial decisions. While there might be a learning curve initially, the rewards of mastering this tool far outweigh the challenges. Embrace the power of the spreadsheet and take control of your financial journey today!

Decoding the mystery of non itchy red dot rashes

Unpacking super bowl lvii the game through espns statistical lens

Understanding the wisconsin gs pay schedule

7.55.10 p. m..png)