Ending Insurance Policies: Understanding the ACORD Cancellation Form

Ending an insurance policy can feel like navigating a maze of paperwork. However, understanding the process, particularly the role of the ACORD cancellation form, can simplify things considerably. This comprehensive guide will demystify the insurance cancellation process and empower you to manage your policies effectively.

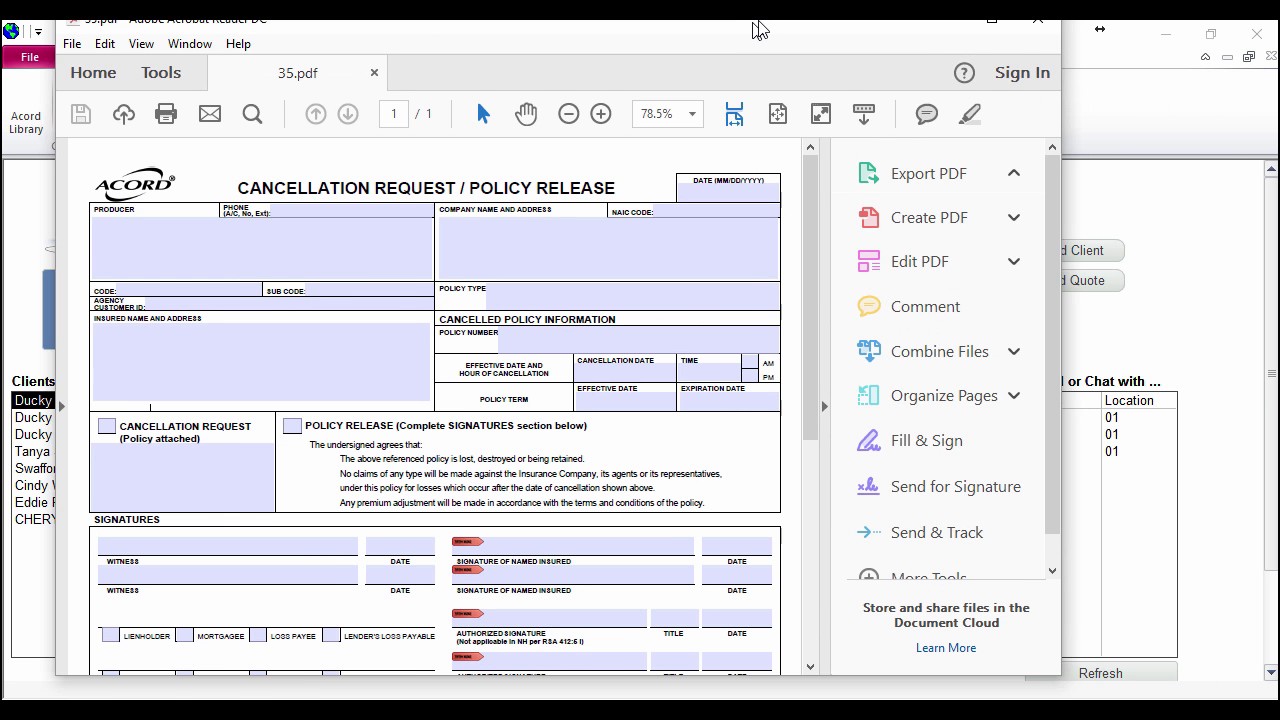

The ACORD cancellation form acts as a standardized document for requesting the termination of an insurance policy. It ensures clear communication between the policyholder and the insurance company, minimizing potential misunderstandings and delays. Whether you're switching insurers, selling a property, or simply no longer require coverage, using the correct cancellation procedure is essential.

While the specific name "ACORD cancellation form" might not be universally used, the underlying principle remains consistent across the industry. Insurers often use their own branded forms, but they generally mirror the data fields and purpose of the standard ACORD form. These forms ensure that all necessary information is captured, streamlining the cancellation process for both parties involved. Key information typically includes policy number, effective date of cancellation, reason for cancellation, and policyholder signature.

Utilizing a formal cancellation process, whether through a specific form or an equivalent method, provides several crucial benefits. It creates a clear audit trail, documenting the request and its processing. This can be vital in resolving any future disputes related to coverage or premiums. Furthermore, it ensures that the cancellation is processed correctly and within the required timeframe, preventing unexpected charges or lapses in coverage.

Misunderstandings and improper cancellations can lead to several issues. A common problem is the continuation of premium payments despite the intended cancellation. This can occur if the cancellation request is not properly submitted or processed. Another issue is a gap in coverage, which can arise if a new policy isn't activated before the old one is terminated. Using a formal cancellation process, including the relevant forms, helps mitigate these risks.

Initiating an insurance policy cancellation often involves contacting your insurance agent or company. They can provide you with the necessary forms or guide you through their specific cancellation process. Clearly stating your reason for cancellation and desired effective date is important. Retaining copies of all documentation related to the cancellation is highly recommended for your records.

One benefit of a formalized cancellation process is the potential for a refund of unearned premiums. If you cancel your policy mid-term, you may be entitled to a refund for the remaining period of coverage. The exact amount and method of refund will vary depending on your policy and insurer.

Another advantage is the avoidance of potential penalties. Some policies impose fees for early cancellation. Understanding the terms and conditions of your policy, and using the correct cancellation procedure, can help minimize or avoid such charges.

A third benefit is the seamless transition to a new policy. By coordinating the cancellation of your old policy with the activation of a new one, you can ensure continuous coverage and avoid potential gaps in protection.

Advantages and Disadvantages of Formal Cancellation

| Advantages | Disadvantages |

|---|---|

| Clear documentation and audit trail | Potential for minor administrative delays |

| Reduced risk of misunderstandings and errors | Requirement to complete forms or follow specific procedures |

| Potential for refund of unearned premiums |

Best Practices for Insurance Cancellation:

1. Review your policy: Understand the terms and conditions related to cancellation, including any potential fees.

2. Contact your insurer: Obtain the necessary forms or instructions for initiating the cancellation.

3. Provide accurate information: Ensure all details on the cancellation form are correct and complete.

4. Maintain records: Keep copies of all documentation related to the cancellation for your records.

5. Confirm cancellation: Follow up with your insurer to verify that the policy has been cancelled effectively.

Frequently Asked Questions:

1. How do I cancel my insurance policy? Contact your insurance company or agent for instructions.

2. Will I receive a refund? It depends on the terms of your policy and the reason for cancellation.

3. What if I don't have a specific cancellation form? Contact your insurer for guidance.

4. When does the cancellation become effective? This depends on your request and your insurer's policies.

5. Can I cancel my policy online? This depends on your insurer's options.

6. What if I cancel mid-term? You may be entitled to a partial refund of premium.

7. Are there penalties for cancelling early? This depends on the specific policy.

8. How do I avoid a lapse in coverage? Coordinate the cancellation of your old policy with the activation of a new one.

In conclusion, understanding the insurance cancellation process, including the use of formal cancellation forms or equivalent procedures, is essential for effective policy management. By following best practices and staying informed, you can ensure a smooth transition, avoid potential issues, and protect your financial interests. Take the time to review your current policies, understand their cancellation terms, and contact your insurer with any questions. Proactive policy management can save you time, money, and potential headaches in the long run.

Unmasking the deception understanding the phenomenon of online catfishing targeting young women

Off black farrow and ball reviews decoded

Anchoring a 40 foot boat finding the perfect fit