Decoding Western Union Transfer Fees: Your Guide to Smart Money Moves

Need to send money across borders? Chances are, Western Union has popped up on your radar. It's a ubiquitous name in the world of money transfers, but navigating the landscape of Western Union transfer money costs can feel like wandering through a maze. This guide aims to demystify the process, providing you with the insights you need to make informed decisions about your international money transfers.

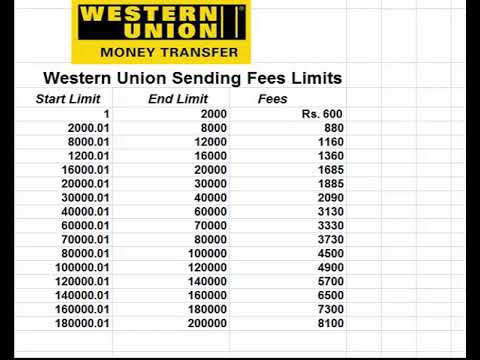

So, how much does it actually cost to send money with Western Union? Well, that's a question with a multifaceted answer. The Western Union money transfer fee isn't a fixed number; it varies based on a cocktail of factors. Where are you sending money from? Where's it going? How much are you sending? Are you paying with a bank account, credit card, or cash? Each of these variables plays a role in determining the final price tag.

Historically, Western Union has been a lifeline for individuals needing to send money quickly across borders. Founded in 1851 as a telegraph company, it evolved into a financial services giant, pioneering the money transfer industry. Today, it boasts a vast global network, facilitating remittances to even the most remote corners of the world. This extensive reach contributes significantly to the Western Union money transfer price, as maintaining such a network incurs substantial costs.

However, the convenience and global reach of Western Union often come at a price. The cost to transfer money through Western Union can be significantly higher than alternative methods, especially for smaller transfers. This has led to increasing scrutiny of Western Union’s pricing structure. Understanding these fees is crucial for ensuring you're getting the best value for your money.

Let's break down the Western Union transfer money cost structure a bit further. Generally, there are two main components: a transfer fee and an exchange rate markup. The transfer fee is the upfront cost associated with sending the money. The exchange rate markup is where Western Union makes a profit by offering an exchange rate slightly less favorable than the mid-market rate. Both these elements contribute to the overall expense, making it crucial to understand how they interact.

One benefit of Western Union is its speed. Money can often be picked up within minutes, making it ideal for urgent situations. Another advantage is its widespread accessibility. With thousands of agent locations worldwide, sending and receiving money is relatively easy, even in areas with limited banking infrastructure. Finally, Western Union offers various transfer options, catering to different needs and preferences.

Advantages and Disadvantages of Using Western Union

| Advantages | Disadvantages |

|---|---|

| Speed and Convenience | Higher Fees Compared to Alternatives |

| Global Reach and Accessibility | Exchange Rate Markups |

| Variety of Transfer Options | Potential for Fraud |

Tips for managing Western Union transfer money costs: Compare rates with other providers, use a debit card instead of a credit card, send larger amounts to minimize the impact of fixed fees, and be mindful of exchange rate fluctuations.

Frequently Asked Questions:

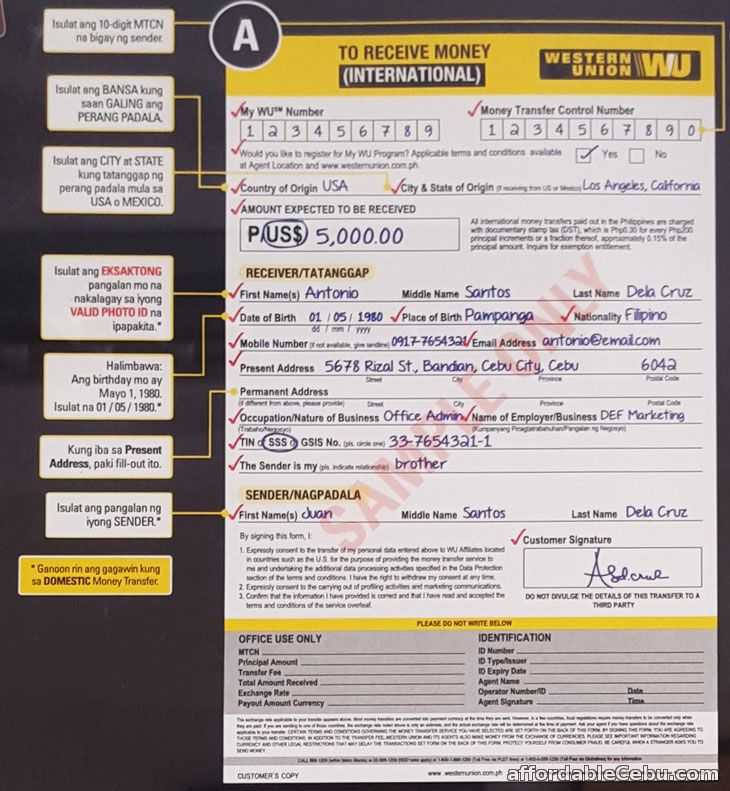

1. How can I track my Western Union transfer? 2. How long does a Western Union transfer take? 3. What are the payment options for sending money through Western Union? 4. Can I cancel a Western Union transfer? 5. What identification do I need to receive money from Western Union? 6. What is the maximum amount I can send with Western Union? 7. Are there any discounts or promotions available for Western Union transfers? 8. What should I do if my Western Union transfer is delayed?

Examples of Western Union transfers: Sending emergency funds to a family member abroad, paying for international tuition fees, supporting a charitable cause in another country, paying for goods or services purchased internationally, receiving freelance payments from overseas clients.

In conclusion, while the cost of transferring money with Western Union can be a significant factor, it’s crucial to weigh it against the service’s speed, convenience, and global reach. By understanding the fee structure and employing smart strategies, you can effectively manage the expense and ensure your money reaches its destination efficiently. Consider comparing Western Union’s pricing with other money transfer providers to determine the most cost-effective solution for your specific needs. Making informed decisions about your remittances will empower you to get the most value for your money, whether you’re supporting loved ones abroad or conducting international business.

Jeep cherokee bolt pattern your ultimate guide

Cruising san antonio your guide to finding the perfect rav4

Conquer your dmv test unlocking success