Decoding Humana Medicare Supplement Plan G: Your Guide to Smart Healthcare

Are you overwhelmed by the alphabet soup of Medicare supplement plans? You're not alone. Choosing the right coverage can feel like a daunting task. This guide simplifies Humana's Medicare Supplement Plan G, helping you understand its intricacies and decide if it's the right fit for your healthcare journey.

Medicare Supplement Plan G, offered by Humana and other insurance providers, is designed to help fill the gaps in Original Medicare coverage. While Original Medicare (Parts A and B) covers a significant portion of your healthcare expenses, you're still responsible for certain out-of-pocket costs like copayments, coinsurance, and deductibles. This is where Medigap Plan G steps in, providing coverage for many of these expenses, offering peace of mind and potentially significant savings.

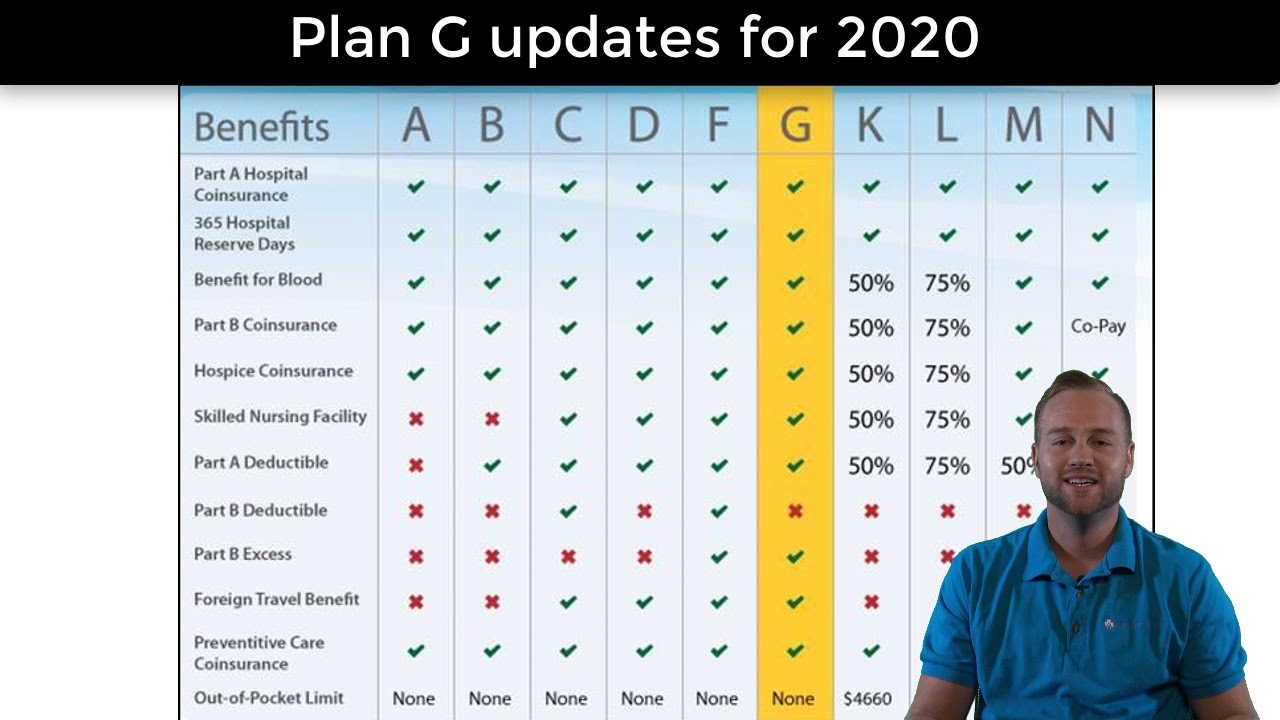

Medicare Supplement plans were standardized in 1992, creating lettered plans (A through N) with consistent benefits regardless of the insurance company offering them. Plan G has consistently been a popular choice due to its comprehensive coverage. Humana, a well-established insurance provider, offers its version of Plan G, allowing beneficiaries to access the plan's benefits through their network.

One of the most significant concerns for beneficiaries considering a Medicare Supplement Plan G with Humana or any other provider is the premium cost. While Plan G offers comprehensive coverage, it comes with a higher premium than some other plans, like Plan N. However, the higher premium can be offset by the peace of mind that comes with knowing you're protected from most out-of-pocket expenses. Choosing the right plan depends on your individual needs and budget.

Understanding the nuances of Humana's Medicare Supplement Insurance Plan G is crucial for making informed decisions about your healthcare. This guide explores the plan's benefits, costs, and other important factors to help you determine if it aligns with your healthcare goals and financial situation.

A Humana Medicare Supplement Plan G covers the Part A deductible, Part B coinsurance or copayment, Part B excess charges, skilled nursing facility coinsurance, and foreign travel emergency (up to plan limits). A key feature of Plan G is that it doesn't cover the Part B deductible.

Three key benefits of Humana's Medigap Plan G are: predictable costs, comprehensive coverage, and travel coverage. Predictable costs mean you know what your out-of-pocket expenses will be, helping you budget effectively. Comprehensive coverage protects you from high medical bills. The foreign travel emergency benefit allows you to access necessary healthcare services while traveling abroad.

Advantages and Disadvantages of Humana Medicare Supplement Plan G

| Advantages | Disadvantages |

|---|---|

| Comprehensive Coverage | Higher Premium |

| Predictable Costs | Doesn't cover Part B deductible |

| Foreign Travel Coverage |

FAQ:

What does Humana's Medicare Supplement Plan G cover? - It covers most out-of-pocket costs associated with Original Medicare except for the Part B deductible.

How much does Humana's Plan G cost? - The cost varies depending on your location and other factors. Contact Humana for a personalized quote.

Can I switch from another Medigap plan to Plan G? - You may be able to switch, but underwriting may be required.

When can I enroll in a Medicare Supplement plan? - The best time to enroll is during your Medigap Open Enrollment Period.

What is the difference between Medicare Advantage and Medicare Supplement? - Medicare Advantage is an alternative to Original Medicare, while a Medicare Supplement works alongside Original Medicare.

Does Plan G cover prescription drugs? - No, you'll need a separate Part D prescription drug plan.

Where can I find more information about Humana's Medicare Supplement Plan G? - Contact Humana directly or visit their website.

Can I keep my doctor with Plan G? - Yes, you can see any doctor who accepts Medicare.

Tips and Tricks: Compare quotes from different insurance companies offering Plan G, including Humana. Consider your current and future healthcare needs when choosing a plan.

Choosing the right Medicare Supplement plan is a vital step in securing your healthcare future. Humana's Medicare Supplement Plan G offers comprehensive coverage, protecting you from most out-of-pocket expenses associated with Original Medicare. While the premium may be higher than some other plans, the peace of mind and financial protection it offers can be invaluable. By carefully considering your individual needs, budget, and healthcare goals, you can make an informed decision about whether Humana's Plan G is the right fit for your healthcare journey. Contact Humana or a licensed insurance agent to discuss your options and get personalized quotes. Don't wait, take control of your healthcare coverage today.

John okeefe canton ma case examination

Start your tuesday right the power of buenos dias feliz martes dios te bendiga

Finding the perfect mattress in fort wayne indiana