Decoding Humana Medicare Plan G Costs

Medicare supplemental insurance, or Medigap, can feel like navigating a digital labyrinth. Plan G, offered by major insurers like Humana, is designed to plug the gaps left by Original Medicare. But how do you decode the cost of a Humana Medicare Plan G? What factors influence the rates, and how can you make sure you’re getting the best value? This exploration into the world of Humana Medicare Plan G pricing aims to demystify the process and empower you to take control of your healthcare decisions.

Understanding Humana’s pricing for Medicare Plan G requires dissecting several key components. Premiums, the monthly fee you pay for the plan, are a significant factor. These can vary based on your location, age, and sometimes even your medical history. Beyond premiums, understanding the plan’s cost-sharing structure is crucial. This includes deductibles, copays, and coinsurance – the expenses you share with the plan after you've met your deductible.

Humana Medicare Plan G rates aren't static. They're influenced by a complex interplay of factors. Inflation, the rising cost of healthcare services, and increasing demand all play a role. Furthermore, government regulations and changes to Medicare itself can ripple through the system, impacting Plan G premiums and out-of-pocket costs. Your specific location also matters; rates can differ significantly from state to state and even within the same state, reflecting variations in local healthcare costs.

Navigating the nuances of Medicare Plan G premiums can be challenging, but it's essential for securing comprehensive coverage. The core purpose of Plan G is to minimize your out-of-pocket expenses for services covered by Original Medicare. This can be particularly important for individuals with chronic conditions or those who anticipate needing significant medical care. By understanding the costs associated with a Humana Medicare Plan G, you can budget effectively and avoid unexpected medical bills.

The history of Medigap plans like Plan G is intertwined with the evolution of Medicare itself. As Medicare evolved, so did the need for supplemental coverage to address its cost-sharing requirements. Plan G emerged as a comprehensive option, covering most out-of-pocket expenses. Its popularity stems from the predictability it offers, shielding beneficiaries from potentially high healthcare costs. However, the rising costs of healthcare have led to increasing Plan G premiums, making it crucial for individuals to carefully evaluate their options and budget accordingly.

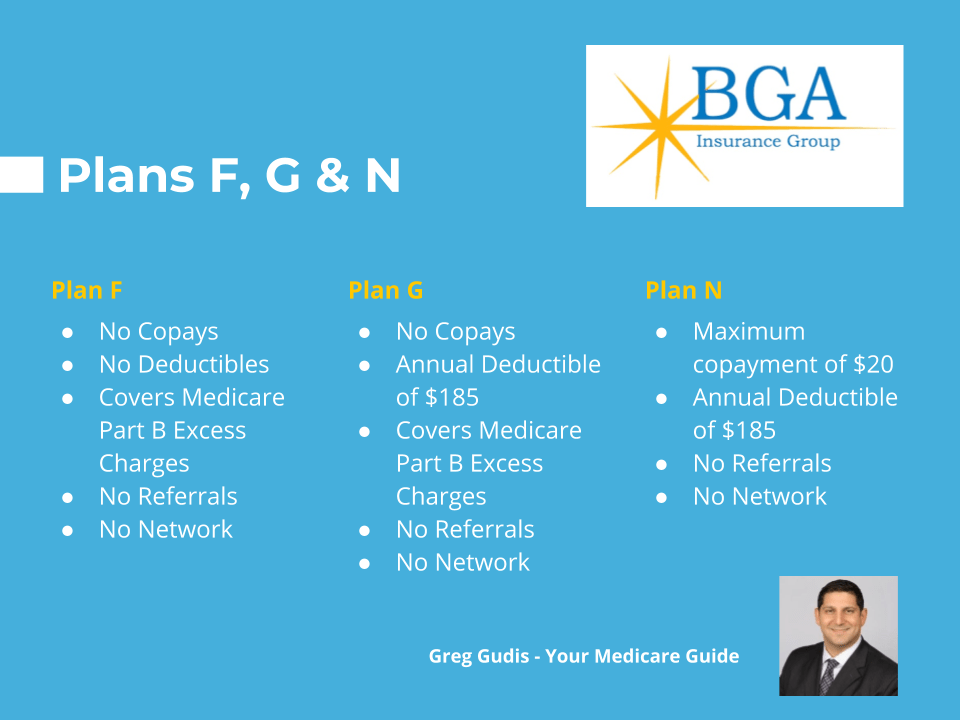

One important aspect is the Medicare Plan G deductible. While Plan G covers most out-of-pocket expenses, you are still responsible for the Part B deductible. Once you meet this deductible, Plan G picks up most of the remaining costs.

Advantages and Disadvantages of Humana Medicare Plan G

| Advantages | Disadvantages |

|---|---|

| Predictable costs | Higher premiums |

| Comprehensive coverage | Doesn't cover Part B deductible |

Best Practices for Choosing a Humana Medicare Plan G

1. Compare Quotes: Use online tools and contact Humana directly to compare Plan G rates in your area.

2. Consider Your Health Needs: Evaluate your current and anticipated medical expenses to determine if Plan G's coverage aligns with your needs.

3. Review Humana's Reputation: Research Humana's customer service and claims processing record.

4. Understand the Fine Print: Carefully review the policy documents to fully grasp the coverage details and any exclusions.

5. Consult with a Medicare Advisor: Seek guidance from an independent advisor who can help you navigate your Medicare options.

Frequently Asked Questions about Humana Medicare Plan G Rates

1. How are Humana Medicare Plan G rates determined? Rates are influenced by location, age, and healthcare costs.

2. Do Humana Plan G rates increase over time? Yes, premiums can increase due to inflation and rising healthcare costs.

3. Can I change my Humana Plan G during the year? Generally, changes are limited to specific enrollment periods.

4. Does Humana offer discounts on Plan G? Contact Humana directly to inquire about potential discounts.

5. What is the difference between Plan G and other Medigap plans? Plan G offers comprehensive coverage but doesn't cover the Part B deductible, unlike some other plans.

6. How do I enroll in a Humana Medicare Plan G? You can enroll online, by phone, or through a licensed insurance agent.

7. Where can I find more information on Humana Medicare Plan G rates? Visit Humana's website or contact their customer service department.

8. Does Humana offer Plan G in all states? Availability may vary by state; contact Humana to verify coverage in your area.

Tips and Tricks: Carefully review your medical expenses and compare quotes from different insurers to ensure you are getting the best value for your money.

Navigating the complexities of Medicare supplemental insurance requires careful consideration and a thorough understanding of the various plan options available. Humana Medicare Plan G, while offering comprehensive coverage for most Medicare cost-sharing, requires a careful examination of its premiums, deductibles, and overall cost. By comparing quotes, understanding the factors that influence pricing, and seeking guidance from reputable sources, you can equip yourself with the knowledge necessary to make informed decisions about your healthcare coverage. Securing adequate and affordable healthcare is a crucial step in safeguarding your financial well-being and overall peace of mind, especially during retirement. Don't hesitate to reach out to Humana directly or consult with a Medicare advisor to delve deeper into the specifics of Plan G and determine if it's the right fit for your individual circumstances. Investing time in researching your options can yield significant long-term benefits and empower you to navigate the healthcare landscape with confidence.

Unpacking super bowl lvii a deep dive into the game

California gun license test your guide

Ultimate comfort seamless socks guide